You don’t have to look much further than the top performing non-leveraged exchange-traded funds (ETFs) in 20201 to realize that many investors are hungry to invest in companies with exposure to the global transition toward clean energy and renewable sources of power generation.

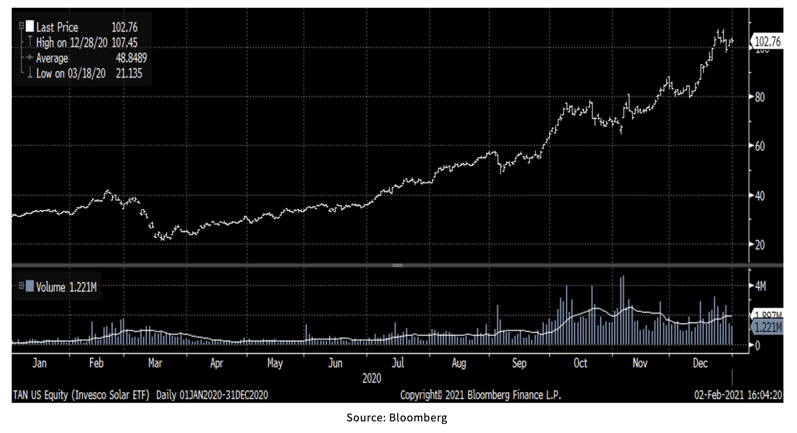

Six of the top ten non-leveraged ETFs ranked by total return in 2020 focused on clean energy1,2. The top performer, Invesco Solar ETF (TAN)3, had an eye-popping total return of 234% last year, as seen in the stock chart below.

We believe that history tells us that it is not unusual to see these types of speculative returns in the early phase of large-scale changes brought on by technological innovation. This pattern has been remarkably similar across many familiar industries – the internet, personal computers, automobiles, and cellular phones. Investors initially flock to securities associated in any way with a new, world-changing product or theme, but ultimately only a handful of companies emerge as the long-term winners.

At Reaves, we expect to see similar dynamics unfold for the companies currently involved in clean energy. Many stocks performed exceptionally well in 2019 and 2020 – the hare is far ahead of the tortoise at this stage of the race - but it is not yet clear which companies will be able to attain profitability and maintain it for five years or longer.

As mentioned in our previous blog post (Utilities Are Spending Big on Renewables – And Investors May Benefit), we believe that most of the utility stocks in our Long Term Value Strategy4 stand to benefit from the ongoing transition to clean, renewable power generation for years to come.

While utility stocks have never generated returns of 200% in a single year, we believe they offer a durable, less volatile way to participate in the growth of renewable power generation.

Our investment team is confident that the earnings and dividend growth rates for the utilities sector can be sustained in the mid-single digit range for the foreseeable future on account of the increased number of renewable power projects that many state regulators need to approve to meet carbon policy goals. Together with our investments in other essential service infrastructure stocks, we believe that our LTV Strategy4 has the potential to continue to generate attractive investment returns in the high-single digit range.

The early days of the Biden administration have shown that addressing climate change is a top priority and all indications are pointing toward an acceleration of the transition to renewable energy that had already been underway. We plan to maintain our investment exposure to the utility companies that are best positioned to benefit from these developments.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1 https://www.thestreet.com/etffocus/market-intelligence/23-top-performing-etfs-return-100-in-2020

2 The 6 of the top 10 non-leveraged ETFs focused on clean energy are: Invesco Solar ETF, Invesco WilderHill Clean Energy ETF, First Trust NASDAQ Clean Edge Green Energy Index ETF, Invesco Global Clean Energy ETF, iShares Global Clean Energy ETF, ALPS Clean Energy ETF. These ETFs are all passively managed with an objective to track different indices comprised of the common stocks of companies associated with the operation and development of renewable or clean energy. The Reaves LTV Strategy uses an actively managed investment approach to select the common stocks of companies operating in infrastructure-related sectors such as utilities, communications services, real estate, and transportation.

3 Invesco Solar ETF (TAN): https://www.invesco.com/us/financial-products/etfs/product-detail?audienceType=Investor&ticker=TAN

4 Beginning December 2019, Reaves LTV Strategy is represented by the LTV SMA Wrap Composite. This composite contains those LTV discretionary portfolios with wrap (bundled) fees. Wrap accounts are charged a bundled fee which includes the wrap sponsor fee, as well as, Reaves’ investment advisory fee. Due to compliance requirements, the net-of-fees calculation is computed based on the highest annual fee assigned by any wrap sponsor who utilizes this portfolio in an investment wrap program (300 basis points from 1/1/03 through 12/31/16 and, effective 1/1/2017, 250 basis points). The LTV SMA Wrap Composite performance consists of money-weighted, time-weighted returns and it includes the reinvestment of all dividends and other earnings. The inception date of the composite is December 2002; however, the composite was created in January 2013. This composite has been managed in a similar manner to the LTV ERISA Composite which ended in December of 2019. The LTV SMA Wrap Composite does not represent all of Reaves’ assets under management.

Past results do not guarantee future performance. Further, the investment return and principal value of an investment will fluctuate; thus, investor’s equity, when liquidated, may be worth more or less than the original cost. This document provides only impersonal advice and/or statistical data and is not intended to meet objectives or suitability requirements of any specific individual or account.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Cash is cash and cash equivalents.

An investor cannot invest directly in an index.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s own individual circumstances from an independent tax adviser.

Fees: Net performance reflects the deduction of advisory fees which are described in detail in our Form ADV Part 2A.

Please contact your financial professional, or click the following links, for a copy of Reaves’ Form ADV Part 2A and Form CRS .” Additional information about Reaves may be found on our website: www.reavesam.com.

2021 © Reaves Asset Management (W. H. Reaves & Co., Inc.)