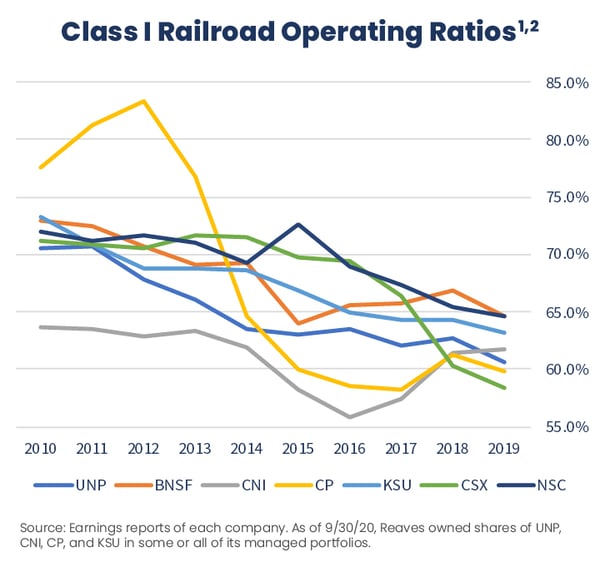

Sometimes an investment thesis is best told through a picture. The chart below illustrates the steadily improving profitability of the seven largest North American railroads.

As discussed in a previous blog, the introduction and implementation of precision railroading techniques has improved operating ratios across the industry through efficiencies such as improved scheduling, and longer, faster railcars requiring less fuel and fewer personnel. We believe the resultant margin expansion has contributed to the ability of these rail stocks to steadily compound value, a trait highly valued at Reaves. Our outlook on the sector is based on the further levering of these initiatives to drive greater efficiencies and the potential for higher volumes as the economy recovers.

Most of our readers are likely familiar with the characteristics Reaves looks for in infrastructure companies, among them high barriers to entry and limited competition. These characteristics support the steady, compounding growth outcomes we seek in our client’s portfolios. With that in mind, the unique nature of North American railroad networks is another reason to consider the group. Disruption of these well-moated networks through the construction of new rail lines would be prohibitively expensive and effectively impossible due to population density and zoning.

Our essential service infrastructure strategies seek to provide high, single-digit total returns through income and capital appreciation with low risk. The characteristics of the largest North American railroads and the major theme driving their durable earnings is why a few have been a mainstay in Reaves’ portfolios.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1Class I Railroads: For regulatory purposes, the Surface Transportation Board categorizes rail carriers into three classes: Class I, Class II, and Class III. The classes are based on the carrier’s annual operating revenues. These thresholds, which were set in 1992, establish Class I carriers as any carrier earning revenue greater than $250 million, Class II carriers as those earning revenue between $20 million and $250 million, and Class III carriers as those earning revenue less than $20 million.

2Operating Ratios: The operating ratio is a major measure of profitability in the railroad industry. This is the company's operating expenses as a percentage of revenue.

Past performance is no guarantee of future results.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax adviser.