In 2020, businesses confronted plenty of challenges. But if dividend growth is any indication, most companies in Reaves’ flagship strategy1 navigated those headwinds quite well.

At Reaves, we believe dividend payments reflect a company’s current financial strength, and the rate and frequency of dividend increases signal management’s confidence in its ability to generate and grow future cash flow. In 2020, there was plenty of reason to have that confidence shaken: by just about any indicator, it was the worst economic backdrop since the financial crisis.

That most companies in Reaves’ Long Term Value Strategy1 not only maintained their dividends - but grew them at a 6.70% rate2 – speaks to their resiliency, in our view.

In the tables below, we have sorted the companies in Reaves’ LTV Wrap Composite by sector, showing their dividend growth in 2020. We’ve also taken the average dividend growth rate3 of the Composite’s holdings in each sector, and compared it to their respective average. We believe these companies’ ability to grow their dividends in excess of the broader sector last year speaks to their strength and aligns with our investment objective to generate both capital appreciation and growth in income.

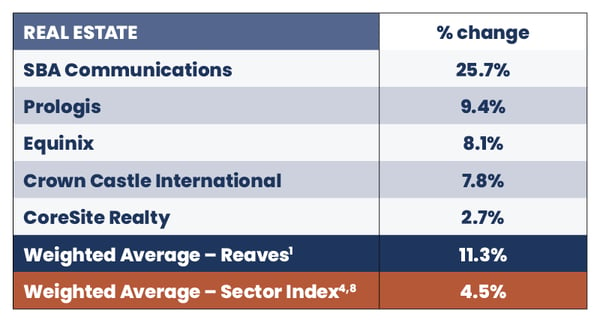

Real Estate Sector

The table below shows the annual dividend increase for each Real Estate stock owned as of December 31, 2020 in a composite of wrap portfolios1 managed with the Reaves Long Term Value Strategy.

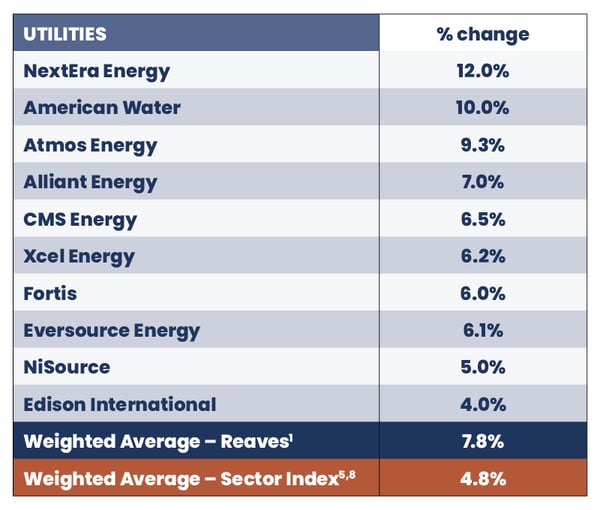

Utilities Sector

The table below shows the annual dividend increase for each Utilities stock owned as of December 31, 2020 in a composite of wrap portfolios1 managed with the Reaves Long Term Value Strategy.

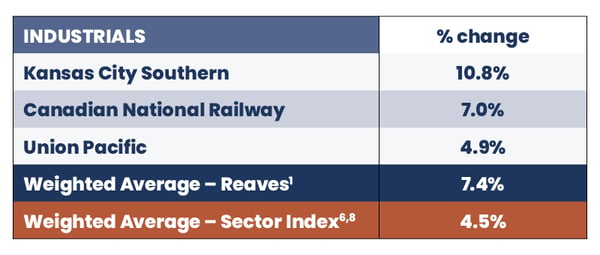

Industrials Sector

The table below shows the annual dividend increase for each Industrial stock owned as of December 31, 2020 in a composite of wrap portfolios1 managed with the Reaves Long Term Value Strategy.

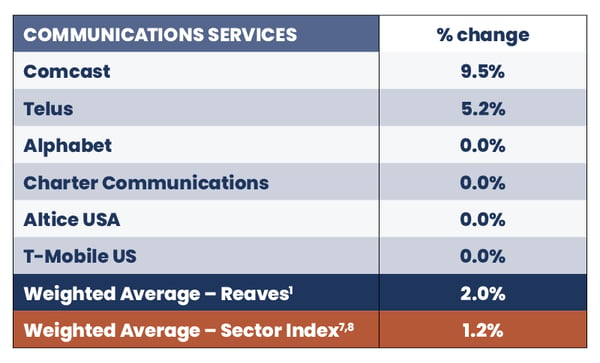

Communications Services Sector

The table below shows the annual dividend increase for each Communications Services stock owned as of December 31, 2020 in a composite of wrap portfolios1 managed with the Reaves Long Term Value Strategy.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1 Beginning December 2019, Reaves LTV Strategy is represented by the LTV SMA Wrap Composite. This composite contains those LTV discretionary portfolios with wrap (bundled) fees. Wrap accounts are charged a bundled fee which includes the wrap sponsor fee, as well as, Reaves’ investment advisory fee. Due to compliance requirements, the net-of-fees calculation is computed based on the highest annual fee assigned by any wrap sponsor who utilizes this portfolio in an investment wrap program (300 basis points from 1/1/03 through 12/31/16 and, effective 1/1/2017, 250 basis points). The LTV SMA Wrap Composite performance consists of money-weighted, time-weighted returns and it includes the reinvestment of all dividends and other earnings. The inception date of the composite is December 2002; however, the composite was created in January 2013. This composite has been managed in a similar manner to the LTV ERISA Composite which ended in December of 2019. The LTV SMA Wrap Composite does not represent all of Reaves’ assets under management.

2 The weighted average of the dividend growth for the utilities, communications services, real estate and industrial sectors plus cash in Reaves’ Long Term Value Strategy Wrap Composite as of 12/31/20.

3 The dividend growth rate is for the 24 companies held in the portfolio as of 12/31/20 -- the portfolio did not necessarily own these stocks for all of 2020. The number of securities excludes two ETFs used temporarily for tax harvesting purposes.

4 The S&P 500 Real Estate Index comprises stocks included in the S&P 500 that are classified as members of the real estate sector.

5 The S&P 500 Utilities Index is a capitalization-weighted index containing electric and gas utility stocks (including multiutilities and independent power producers). Prior to July 1996, this index included telecommunications equities.

6 The S&P 500 Industrials Index comprises those companies included in the S&P 500 that are classified as members of the industrials sector.

7 The S&P 500 Communication Services Index comprises those companies included in the S&P 500 that are classified as members of the communication services sector.

8 We excluded companies with a dividend increase or decline of greater than 50% to reduce data distortion. We also excluded companies which initiated a dividend due to the inability to calculate a percentage change from a starting point of zero:

Real Estate sector: 4 companies excluded representing 7.6% weighting by market capitalization.

Utilities sector: 2 companies excluded representing 2.4% weighting by market capitalization.

Industrials sector: 12 companies excluded representing 15.3% weighting by market capitalization.

Communications Services sector: 2 companies excluded representing 10.2% weighting by market capitalization.

Weighted average is a calculation that takes into account the varying degrees of importance of the numbers in a data set. In calculating a weighted average, each number in the data set is multiplied by a predetermined weight before the final calculation is made.

Past performance is no guarantee of future results.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

An investor cannot invest in an index.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax adviser.