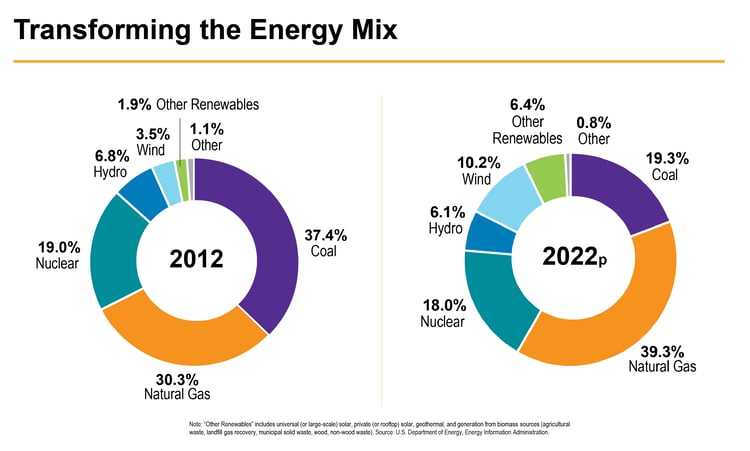

As a growing subset of investors look for their assets to achieve both positive returns — and positive societal change — they may want to consider utilities. True, the industry doesn’t currently have the lowest carbon footprint: In 2022 nearly 60% of energy generated in the United States came from coal and natural gas. But perhaps no other sector provides a greater opportunity to significantly reduce carbon emissions and directly impact the environment. We believe the ongoing renewable energy transition will continue to drive accelerating capital spending and earnings growth for many utility companies while diversifying the generation mix and positively impacting the environment by way of lower carbon emissions. The recently passed Inflation Reduction Act (IRA), which includes ambitious carbon emission goal targets and government support by way of tax credits, should further strengthen utility fundamentals as well as their environmental impact potential.

The argument may seem counterintuitive. ESG (Environmental, Social, and Corporate Governance)-labeled strategies, which typically appeal to investors wanting to affect change, tend to own companies that are considered to already have relatively minimal impact on the environment. Tech companies like Meta and Alphabet are examples. However, we believe this group of companies will not necessarily be the ones to actually improve the quality of the environment in the future.

For utilities, the potential for positive future environmental impact is much clearer. When investors participate in a utility company’s debt or equity offering, they are often providing capital for that utility to build new wind and solar facilities that will displace fossil-fuel-sourced power and, ultimately, make the energy grid greener. We believe investors who buy and hold utility stocks will play a role in lowering the cost for these companies to raise capital to support renewable development investments that will directly reduce their carbon footprints over time.

The chart below shows renewable generation, which includes solar, wind, hydro, and other renewable sources, represented only 22.7% of total U.S. energy generation in 2022, up from 21% in the prior year and 12.2% in 2012.

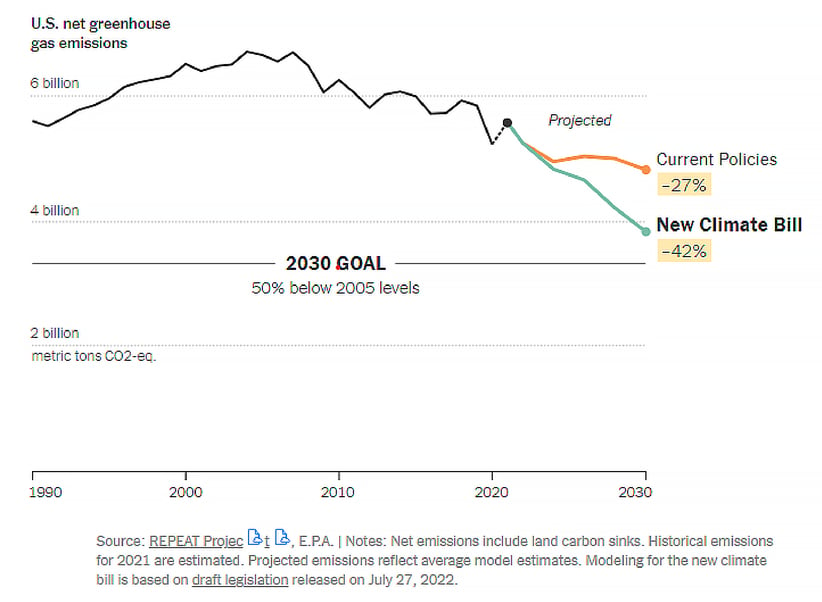

The passage of the IRA last August, with guidelines to reduce U.S. greenhouse gas emissions by 30% this decade and nearly 40% by 2040, as compared to 2005 levels, is expected to accelerate renewable transition and the spending associated with it. The legislation provides up to $160 billion in tax credits for renewable development projects to drive investment to meet those targets.

Renewable transition and the carbon emission reductions associated with it highlight how utility investors are making an environmental impact while also benefiting from the potential for increased earnings and dividend growth rates associated with it. Many utility companies are also creating other smaller, but still significant, programs and services that will help to reduce future levels of energy consumption, many of which are also included in the IRA’s tax credits.

Examples include the buildout of electric vehicle charging stations, subsidizing the purchase of energy-efficient household appliances, and conducting energy audits to help customers identify ways to make their homes more energy efficient. Other examples include starting initiatives that encourage heat pump installations — a device that lowers household energy use in the summer and winter.

Examples include the buildout of electric vehicle charging stations, subsidizing the purchase of energy-efficient household appliances, and conducting energy audits to help customers identify ways to make their homes more energy efficient. Other examples include starting initiatives that encourage heat pump installations — a device that lowers household energy use in the summer and winter.

With the environmental impact investments utility companies are making combined with the recent policy support behind these investments, we believe there are few places investors can put their money and see it drive greater environmental change. The long-term tailwind for these investments should, in our opinion, continue to drive the ability of utility companies to compound earnings and dividend growth for many years to come.