In response to the Federal Reserve’s efforts to cool surging inflation by raising interest rates, the S&P 500 Index1 has fallen almost 13% through the end of May. One bright spot has been the utility sector, which is up by nearly 5% as measured by the S&P 500 Utilities Index2, making it the second-best performing sector year to date. Since utility stocks often are seen as proxies for bonds — which often perform poorly during periods of rising inflation and interest rates — many investors may be wondering what’s going on. Here’s the story:

Utilities offer competitive returns and lower risk

For investors who believe bond returns in the medium term are not likely to outpace inflation, utilities may be an attractive alternative. To start, utilities are providers of essential services — water, electricity, and natural gas — that are necessary regardless of economic conditions. As regulated monopolies, utilities also benefit from their ability to recover their costs and earn an allowed return through rates charged to their customers. The result is a durable earnings and dividend stream that has the lowest beta, a measure of volatility, of any other sector in the market. Additionally, during periods of elevated inflation and rising interest rates, utility stocks have generally outperformed bonds.

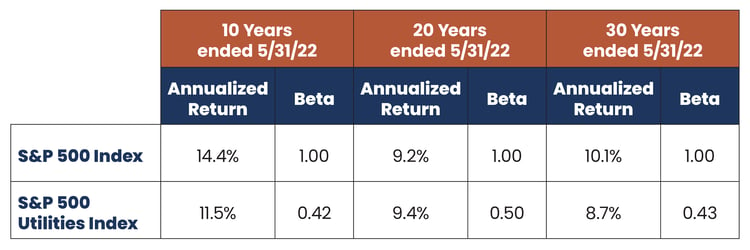

In fact, as the data in Table 1 below illustrates, utility stocks have performed nearly as well as the broad stock market over several time periods in the past, yet with half, of the stock market’s volatility.

Table 1.

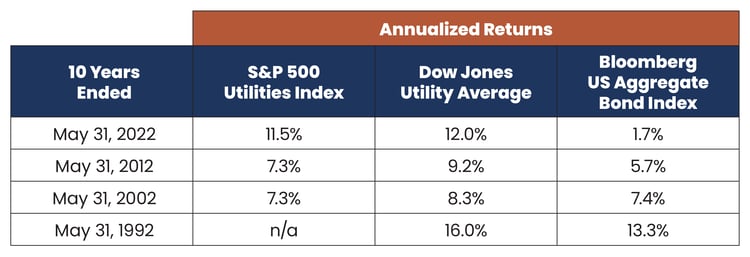

Investors may be surprised by how little they must give up in the way of performance vis-à-vis other equity sectors to get such a large reduction in volatility or systematic risk. For fixed-income investors, the defensive characteristics of utilities and their relative performance to bonds may be important to consider. For example, In four consecutive 10-year periods from June 1982 through May 2022, utility stocks consistently outperformed the bond market. See Table 2.

Table 2.

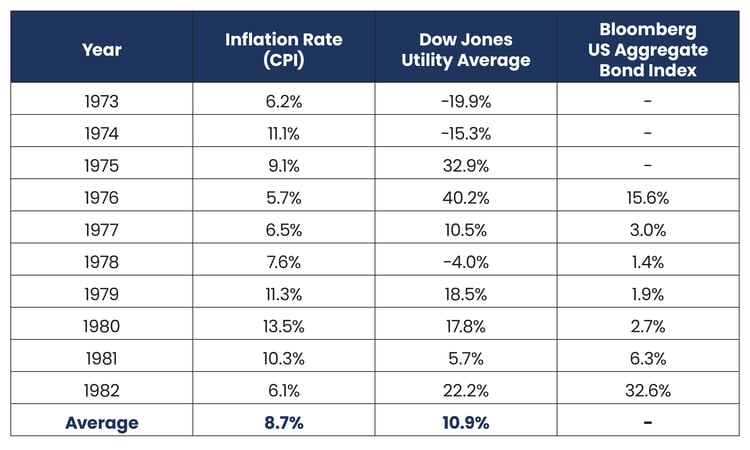

Moreover, during years of historically high inflation, gains in utility shares generally outpaced increases in the Consumer Price Index (CPI), a widely used measure of inflation. Over those same periods, bond gains generally lagged the rate of inflation as well as the performance of utility stocks.

Table 3.

The need for diversification when investing in utilities

Given the appeal of utilities as a fixed-income replacement during periods of elevated inflation, investors should consider two factors, the first being diversification. While there are many utilities in which to invest, only 29 utility stocks are included in the S&P 500 Index. They account for just 2.7% of the index on a combined-weighting basis (as of March 31, 2022), meaning utilities can easily be overlooked and under-represented in a portfolio. We believe the characteristics and historical performance of utilities versus bonds and the market supports increasing their allocation in a diversified portfolio.

Additionally, due to the varied nature of state regulations and service areas, as well as management quality, financial characteristics, and growth prospects, each utility company's story is unique. That leads to the second consideration when investing in utilities, specialized knowledge, and investment experience in the sector.

The need for deep sector knowledge when investing in utilities

Active management can be an important contributor to investment outcomes in all equities, including utilities. Because utilities are such a small share of the market overall and a niche often overlooked by investors, it is an area that is under-researched relative to other sectors of the market. In addition, the complexity of regulation and capital structure within the industry often means that many risks as well as opportunities can go unnoticed by most of the investment community.

Passively managed utility funds, which track utilities indices, by their nature cannot exclude utilities that may present unwarranted risk. Since they are based on capital weighting, passively managed index funds may under-represent utilities that offer the greater potential for capital appreciation. Active management in the utility space, therefore, can provide demonstrable value.

Bottom line: In periods of rising inflation, a well-managed utility portfolio may be a viable substitute for traditional fixed-income investors who anticipate lower returns. History has shown that in exchange for accepting a small additional measure of risk, investors in appropriately selected and well-managed utility portfolios may be able to enjoy performance that can keep up with inflation and may even exceed that of the market generally. To find out how the utility industry expertise of Reaves Asset Management may be put to use to meet your investment objectives, please visit our website.