Since its inception, wireless services have enabled communication advancements from voice calling to text to social networking and videoconferencing. Work applications have morphed from basic email to web search, data analytics, and file sharing. Regulators have rewarded these innovations by making more wireless spectrum – the foundation of wireless networks – available for broadband applications. What’s more, we believe governments around the world view enabling high-quality wireless communications networks to be an essential policy component to drive both economic growth and promote national security. Accordingly, governments have and continue to reallocate ever more wireless spectrum to mobile broadband. In turn, wireless carriers can satisfy the insatiable consumer demand for data and spark the entrepreneurial spirit that might create the productivity-enhancing application of tomorrow’s economy.

We believe the most efficient way for carriers to deploy that spectrum to its highest and best use is to rent space on wireless towers and to hang two-way radio equipment. At Reaves, we take the perspective that the business model resulting from this dynamic is as good as any in the global economy. Most of our managed portfolios have had exposure to towers for over a decade and we continue to be attracted by the outlook today. As with most of our managed portfolios’ core investments, the durability of the cash flow streams, which support growing distributions, is one of the characteristics that gets us most excited.

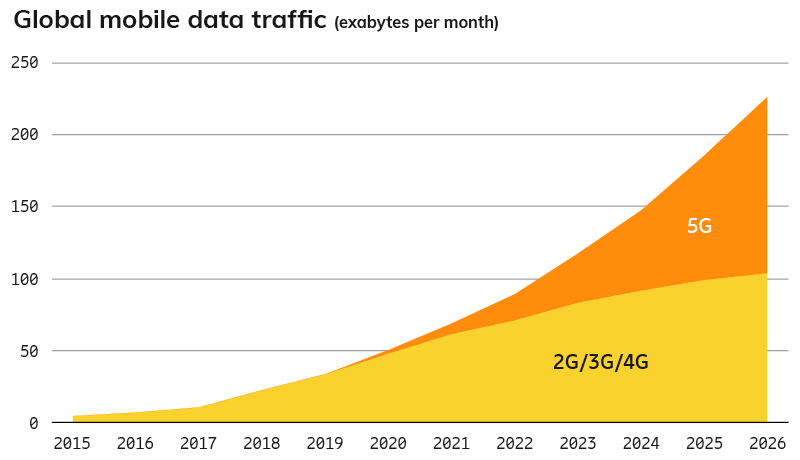

Source: Ericsson Mobility Report, page 13, November 2020,

Source: Ericsson Mobility Report, page 13, November 2020,

https://www.ericsson.com/4adc87/assets/local/mobility-report/documents/2020/november-2020-ericsson-mobility-report.pdf

This graph does not include traffic generated by fixed wireless access (FWA) services.

The Business Model

We believe uncommonly low technology risk, prohibitive zoning, and extraordinarily high switching costs are a potent mix of defensible characteristics within the wireless tower business model. For starters, strict zoning regulations make new tower construction incredibly challenging. This dynamic is reinforced by community aversion to the construction of what are generally believed to be unsightly metal towers. As a result, the existing tower inventory in the U.S. hasn’t changed much in recent years despite the underlying demand.

Further, existing cellular network architecture has been designed to optimize both coverage range and data capacity. This engineering work has been reinforced across multiple generations of wireless technologies – it would be expensive, time-consuming, and extremely complex to undo. This makes technology substitution risk low.

Similarly, high switching costs for carriers positions towers with material leverage when negotiating lease terms with carriers. Alternative technologies for propagating a wireless network, whether they be fiber, satellite, or other, have coverage and capacity limitations on top of unworkable economics. Therefore, a move away from the existing model would not only be expensive, but also come with a lower quality consumer experience.

The resulting contracts between carriers and towers are generally noncancellable and incredibly long-lived. Leases also include annual escalators in excess of inflation. What’s more, the leases effectively sit very high in wireless carrier capital structures given that they are essential to servicing all other liabilities.

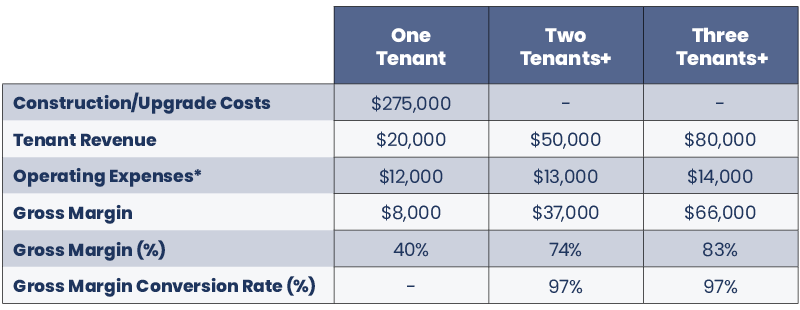

Towers also benefit from low, ongoing capital requirements as these wireless infrastructure landlords incur relatively minimal costs to maintain their tower sites. Simply put, there isn’t much that goes into maintaining metal poles. Accordingly, returns from each tower increase significantly as additional tenants are added. The table below, from a recent presentation by American Tower1, highlights the change in profitability for each tower as it adds tenants:

For illustrative purposes only. Does not reflect any American Tower financial data.

+ Colocating tenants typically pay higher rents than anchor tenants on build-to-suit towers.

* includes ground rent, utility, and monitoring

Source: American Tower “Introduction to the Tower Industry and American Tower”, data from slide 18, December 2020, https://www.americantower.com/investor-relations/investor-presentations/

Outlook

Beyond the defensibility of the business model, several recent data points also support a positive outlook for tower companies. First, the completed mega-merger of Sprint and T-Mobile US1 places formerly dormant spectrum in the hands of a well-capitalized operator in T-Mobile, who has begun to put it to work on towers in an effort to differentiate its network. A condition of that same deal has also catalyzed the deployment of DISH Network’s similarly unused wireless assets. We believe towers stand to benefit in both cases for years to come.

Second, a large swath of newly auctioned spectrum is set to drive accelerating tower leases in the coming years. In particular, the recent C-Band spectrum auction fetched nearly one hundred billion dollars from wireless carriers and others. Until deployed on towers, these new wireless assets are useless to carriers. We expect towers will begin to see the benefits of the C-Band auction results beginning later this year.

The future appears bright for communications infrastructure spending. As network service providers, enterprises, and governments alike plan for the economy of the future, 5G applications are being developed to improve efficiency and drive economic growth. At Reaves, we believe towers are particularly well positioned to capitalize on that innovation.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1 As of Reaves’ 13F filing on 12/31/20, American Tower and T-Mobile US were held in some portfolios managed by Reaves Asset Management.

Beginning December 2019, Reaves LTV Strategy is represented by the LTV SMA Wrap Composite. This composite contains those LTV discretionary portfolios with wrap (bundled) fees. Wrap accounts are charged a bundled fee which includes the wrap sponsor fee, as well as, Reaves’ investment advisory fee. Due to compliance requirements, the net-of-fees calculation is computed based on the highest annual fee assigned by any wrap sponsor who utilizes this portfolio in an investment wrap program (300 basis points from 1/1/03 through 12/31/16 and, effective 1/1/2017, 250 basis points). The LTV SMA Wrap Composite performance consists of money-weighted, time-weighted returns and it includes the reinvestment of all dividends and other earnings. The inception date of the composite is December 2002; however, the composite was created in January 2013. This composite has been managed in a similar manner to the LTV ERISA Composite which ended in December of 2019. The LTV SMA Wrap Composite does not represent all of Reaves’ assets under management.

Past results do not guarantee future performance. Further, the investment return and principal value of an investment will fluctuate; thus, investor’s equity, when liquidated, may be worth more or less than the original cost. This document provides only impersonal advice and/or statistical data and is not intended to meet objectives or suitability requirements of any specific individual or account.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Cash is cash and cash equivalents.

An investor cannot invest directly in an index.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s own individual circumstances from an independent tax adviser.

Fees: Net performance reflects the deduction of advisory fees which are described in detail in our Form ADV Part 2A.

Please contact your financial professional, or click the following links, for a copy of Reaves’ Form ADV Part 2A and Form CRS .” Additional information about Reaves may be found on our website: www.reavesam.com.

2021© Reaves Asset Management (W. H. Reaves & Co., Inc.)