Superstorm Sandy, the strongest, most destructive hurricane of the 2012 Atlantic hurricane season, slammed ashore in New Jersey and New York on October 29, 2012, leaving most homes and businesses in the region without power and rendering our offices in Jersey City uninhabitable for days. Fortunately, Reaves’ IT team had laid the necessary groundwork for our Firm to seamlessly operate remotely, a capability that has also allowed our employees to continue working effectively and serve our clients since the onset of the global pandemic.

One of the primary enablers of our remote infrastructure capabilities, then and now, is cloud connectivity. When Sandy made landfall, not far away from our headquarters – in the New Jersey Meadowlands – computer servers stacked up in rows across sprawling data centers were humming away. The data center operators, their back-up fuel suppliers, and the government had coordinated to ensure ample power to ride out the storm regardless of duration. Indeed, many data centers were turning away fueling trucks due to excess capacity. Why the belt-and-suspenders approach? Many of Wall Street’s most important financial institutions transact commerce in these cloud facilities. That is, stakeholders were worried that if a powerful storm like Sandy were to knock out power to New Jersey’s data centers, the global financial system might grind to a halt.

There are several types of data centers. Some are farm-sized single-tenant facilities, often in remote locations, where cloud service providers crunch enormous amounts of data and manage less time sensitive applications. Others are heavily interconnected facilities located closer to dense population centers with hundreds of customers. In these facilities, dozens of telecom networks interconnect, enterprises remotely manage critical workloads, and cloud service providers analyze data and help optimize business decision-making. At Reaves, we are attracted to the latter. We believe this type of ecosystem – like the one that exists for financial services in Northern New Jersey – is an essential infrastructure component of the modern economy.

History of Interconnection

The largest operator of these interconnection, or colocation-focused facilities, is a multinational company based in California named Equinix1. According to their website, the company’s name stands for equal access, neutrality, and interconnection, and we believe, these principles are what differentiates these types of data center assets. Equinix has been a core holding of the Reaves Long Term Value investment strategy2 since 2018.

Many colocation facilities began as “carrier hotels,” when global telecom networks handed off traffic in a mutually beneficial way. Often times, this occurred when subsea cables connecting continents landed near dense population centers. This solution worked well in an analog or a voice-centric world, but became complicated when broadband networks – with more demand for data downloads than for uploads – created traffic asymmetry. The resulting conflict of interest forced these carrier hotels into the hands of neutral third parties. The colocation business model that enables the cloud economy was thus born.

Strong Industry Growth

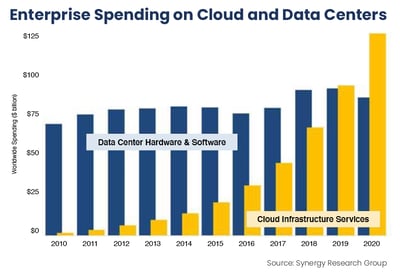

As IT managers have realized the cost benefits of outsourcing workloads to cloud service providers, and as product managers have recognized that the seamless use of applications is critical to customer satisfaction, the cloud infrastructure industry has displayed robust growth. Capital investment and ongoing product improvements from mega-cap technology companies like Amazon, Microsoft, and Alphabet3 have accelerated the trend. Still, a significant amount of global workloads are managed on-site or in private facilities, leaving a long runway for growth. Indeed, spending on cloud infrastructure has only recently surpassed that of legacy infrastructure.

Link to Source: https://www.crn.com/news/data-center/cloud-services-reach-130b-dwarfs-data-center-spending - March 24,2021

Network Effects are Powerful

Colocation facilities, with lots of interconnecting telecom networks and cloud on-ramps, create captive enterprise customers. If you need to be colocated with suppliers and distributors, or care about speed to market and security, or manage applications where latency can result in lost customers, you need to transact in the cloud. As a result, data centers’ tenants often refer to the rents they pay to cloud landlords as a tax on the internet.

As financial analysts, we view this less pejoratively – it’s a business model with high recurring revenue and strong pricing power. As industry analysts, we think this is as pure a network effect as we observe, given that each time a new tenant is added, the value of the facility is increased. The image below from an Equinix analyst day in June 2018 neatly illustrates this dynamic. Each time a red cable connects with another endpoint, it’s harder for the rest of the red cables (representing enterprise, carrier, and cloud tenants) to disconnect:

Link to Source: Equinix, Inc. – slide 6 - https://equinixinc.gcs-web.com/static-files/63ff9dd1-8f3d-4e1d-bf22-1d8d3d94e3c5 - June 21, 2018

In Summary

At Reaves, we expect attractive returns and growth from our data center investments due to the following:

- Customers who view the service to be largely non-discretionary

- Corresponding pricing power

- Powerful secular trends

- A real estate structure that shields operators from paying taxes

- Requirements for annual cash flow distributions

We believe these characteristics may support the low risk, total return objectives of our managed portfolios for years to come.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1 As of Reaves’ 13F filing on 12/31/20, Equinix was held in some portfolios managed by Reaves Asset Management.

2Beginning December 2019, Reaves LTV Strategy is represented by the LTV SMA Wrap Composite. This composite contains those LTV discretionary portfolios with wrap (bundled) fees. Wrap accounts are charged a bundled fee which includes the wrap sponsor fee, as well as, Reaves’ investment advisory fee. Due to compliance requirements, the net-of-fees calculation is computed based on the highest annual fee assigned by any wrap sponsor who utilizes this portfolio in an investment wrap program (300 basis points from 1/1/03 through 12/31/16 and, effective 1/1/2017, 250 basis points). The LTV SMA Wrap Composite performance consists of money-weighted, time-weighted returns and it includes the reinvestment of all dividends and other earnings. The inception date of the composite is December 2002; however, the composite was created in January 2013. This composite has been managed in a similar manner to the LTV ERISA Composite which ended in December of 2019. The LTV SMA Wrap Composite does not represent all of Reaves’ assets under management.

3 As of Reaves’ 13F filing on 12/31/20, Alphabet Inc. was held in some portfolios managed by Reaves Asset Management.

Past results do not guarantee future performance. Further, the investment return and principal value of an investment will fluctuate; thus, investor’s equity, when liquidated, may be worth more or less than the original cost. This document provides only impersonal advice and/or statistical data and is not intended to meet objectives or suitability requirements of any specific individual or account.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Cash is cash and cash equivalents.

An investor cannot invest directly in an index.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s own individual circumstances from an independent tax adviser.

Fees: Net performance reflects the deduction of advisory fees which are described in detail in our Form ADV Part 2A.

Please contact your financial professional, or click the following links, for a copy of Reaves’ Form ADV Part 2A and Form CRS .” Additional information about Reaves may be found on our website: www.reavesam.com.

2021© Reaves Asset Management (W. H. Reaves & Co., Inc.)

.png?width=400&name=2021.04%20Reaves%20Blog%2048%20Chart%202%20(2).png)