Utilities have traditionally been viewed by investors as ideal widow-and-orphan stocks, valued for having attractive dividend yields and lower risk. However, the sector has much more differentiation than one might think.

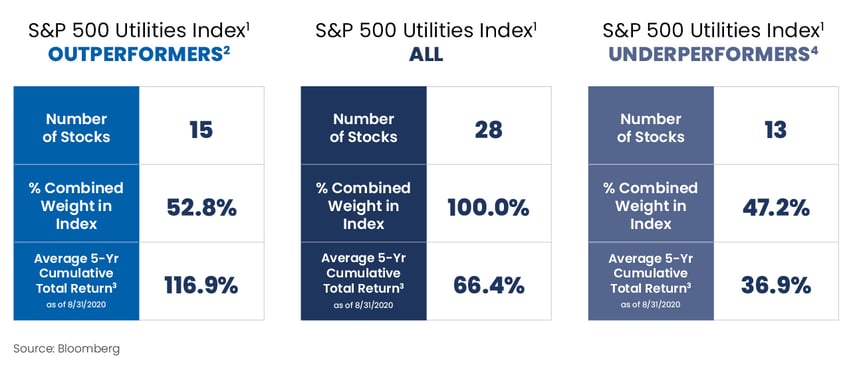

Over the past five years, the S&P 500 Utilities Index1 has increased by 66.4% but there was a substantial gap in performance between the stocks that exceeded the return of the Index and those that did not. The wide gap highlights the need for active management in the sector, as active managers have the potential to add value by not owning some of the lower-quality stocks in the index that can drag on sector performance. Later in this blog, we discuss three of those stocks, and the reasons we believe they underperformed.

Why Have Some Stocks Underperformed?

At Reaves, we find many utility stocks that fit our essential service investment focus. We’ve written about it in many blogs, but our holdings always comprise a few key characteristics: The businesses have high barriers to entry, provide services that are absolutely essential for modern society to function and often operate in highly regulated industries. Companies that meet such criteria tend to have consistent earnings and dividend growth. Many utility stocks meet all the criteria … but not every utility.

Below, we highlight three utility stocks that have underperformed in recent years due to a variety of poor decisions that, in our view, made their businesses riskier. In many cases, the missteps of these companies were not intuitive, and an investor could be deceived into thinking the company is taking the right action or bearing the appropriate level of risk. Valuations at times may have been enticing but the strategies these companies undertook led to a long stretch of underperformance.

The stocks are all large index holdings — collectively making up 15% of the S&P 500 utilities sector— which highlights why active management and a deep understanding of the companies in the sector is so important.

Duke Energy Corp.*: Within the last five years, the company sold several poorly performing businesses including power generation assets and international utilities. At the time, these decisions created positive sentiment because of the potential to transition the earnings mix closer to fully regulated U.S. assets, which would mean more predictability and less volatility of earnings streams. However, as it sold businesses, Duke diluted earnings per share and hurt the stock valuation.

At the same time, Duke tried to play catch up with other utilities which were touting gas utility and renewable exposure. The company attempted to enter those businesses and fill the earnings hole created by its original asset sale. In the process, Duke acquired a gas utility and an interest in interstate gas pipeline development projects while materially increasing investments in its unregulated renewable energy business.

The company ended up vastly overpaying for the gas utility and earlier this year the oft-delayed and well-over-budget gas pipeline development efforts culminated in a multibillion dollar write-off and project cancellation. Meanwhile, the unregulated renewable development efforts have struggled to generate consistent and appropriate risk adjusted returns as the company entered the business late and possessed little competitive advantage in developing projects.

Exelon Corp.*: In recent years the company has taken several investor friendly actions to enhance the quality of its earnings mix. The company’s efforts centered on moving toward more regulated businesses – which have more predictable and less volatile earnings – and away from unregulated utilities. They did this by acquiring a sizeable adjacent regulated utility (Pepco) and increasing regulated utility spending at its own businesses. After cutting its dividend in 2013 and leaving it flat for the ensuing three years, Exelon also made the decision to start growing its dividend again.

While these moves appear favorable, the company still relies heavily on cash flow generated by its unregulated power generation business to fund regulated spending opportunities and thus maintains significant exposure to the commoditized merchant power market. This business carries significant risk relative to a regulated business as it is very cyclical and reliant on commodity prices, economic growth and a variety of other exogenous factors to increase earnings. Regulated businesses, on the other hand, are mostly reliant on a state regulator and favorable regulation to increase earnings.

Historically, the unregulated business was cyclical, with booms always followed by busts. In the last decade, however, this has changed as power markets seem to have been structurally damaged by the emergence of and continued development of low-cost renewables. Power prices have remained depressed calling into question the economic life and long-term value of Exelon’s fleet of power generation assets and their high fixed costs.

Consolidated Edison (ConEd)*: Despite being deemed a "safe and boring utility," the company has made several significant value destructive M&A transactions in the last few years. ConEd acquired a poorly positioned gas midstream business, an ownership interest in a large - and in our view – risky gas pipeline (Mountain Valley) that was overbudgeted and delayed, and acquired portfolios of significant renewable energy assets. The net effect of these actions – which were seen by many as accretive and shareholder friendly at the time – has been weak earnings growth over the last few years.

Several aspects of ConEd’s business profile may be intuitively attractive to utility investors: It is the second largest owner of solar in North America and seventh largest in the world, owns very few carbon emitting power generation assets, has a plethora of clean energy/de-carbonization commitments and strong rate base growth. But weak earnings continue to weigh on the stock price.

Bottom Line: Utility Businesses Vary Considerably and Require a Selective Approach

The results of some of the sector’s underperformers highlight how varied utility stock performance can be, and why we believe investing in the sector requires an active approach. By picking individual companies, and not investing in a passive sector fund, investors could gain exposure to quality utilities and take less risk while avoiding the dilution of returns that comes from exposure to some of the riskier-looking companies in a sector benchmark.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1The S&P 500 Utilities Index is a capitalization-weighted index containing electric and gas utility stocks (including multiutilities and independent power producers). Prior to July 1996, this index included telecommunications equities.

2Outperformers refers to the stocks in the S&P 500 Utilities Index which had a higher cumulative total return over the past 5 years than the Index itself.

3Cumulative Total Return is the percentage increase in the value of an investment including the reinvestment of dividends

4Underperformers refers to the stocks in the S&P 500 Utilities Index which had a lower cumulative total return over the past 5 years than the Index itself

*As of 8/31/20, Duke Energy Corporation is owned by some accounts managed by Reaves Asset Management. Other clients of Reaves Asset Management have owned Exelon Corporation and Consolidated Edison in the past.

Past performance is no guarantee of future results.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax adviser.