Disclosures and Definitions:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

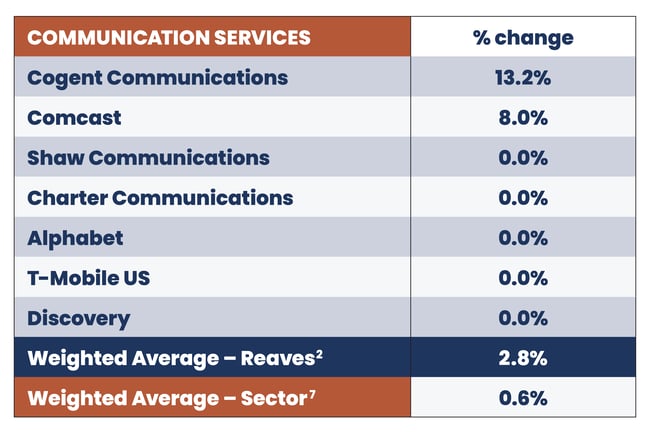

1 As of 3/31/22, the composite included six companies which do not currently pay a dividend. They are Charter Communications, Alphabet, T-Mobile US, Discovery, GXO Logistics and PG&E.

2 Reaves LTV Strategy is represented by the LTV SMA Wrap Composite. This composite contains those LTV discretionary portfolios with wrap (bundled) fees. Wrap accounts are charged a bundled fee which includes the wrap sponsor fee, as well as, Reaves’ investment advisory fee. Due to compliance requirements, the net-of-fees calculation is computed based on the highest annual fee assigned by any wrap sponsor who utilizes this portfolio in an investment wrap program (300 basis points from 1/1/03 through 12/31/16 and, effective 1/1/2017, 250 basis points). The LTV SMA Wrap Composite performance consists of money-weighted, time-weighted returns and it includes the reinvestment of all dividends and other earnings. The inception date of the composite is December 2002; however, the composite was created in January 2013. This composite has been managed in a similar manner to the LTV ERISA Composite which ended in December of 2019. The LTV SMA Wrap Composite does not represent all of Reaves’ assets under management.

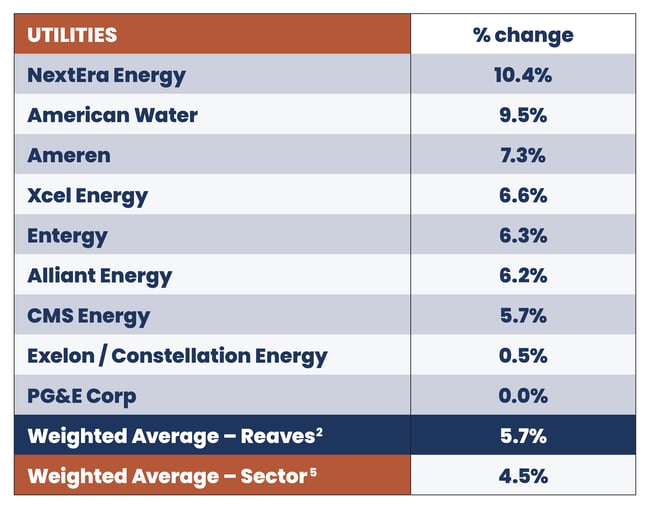

3 During Q1 2022, Exelon Corp spun off Constellation Energy to its shareholders. Exelon shareholders received 1 share of Constellation for each 3 shares of Exelon held. Exelon reduced its quarterly dividend from $0.3825 to $0.3375 and Constellation initiated a quarterly dividend of $0.141. The Q1 2022 combined dividends totaled $0.3845, a slight increase from the Q1 2021 quarterly dividend from Exelon of $0.3825.

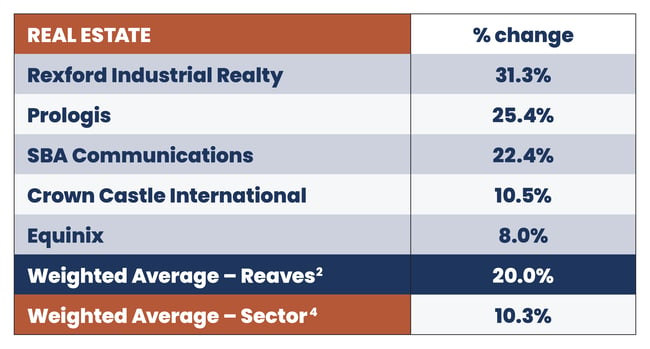

4 The S&P 500 Real Estate Index comprises stocks included in the S&P 500 that are classified as members of the real estate sector.

5 The S&P 500 Utilities Index is a capitalization-weighted index containing electric and gas utility stocks (including multiutilities and independent power producers). Prior to July 1996, this index included telecommunications equities.

6 The S&P 500 Industrials Index comprises those companies included in the S&P 500 that are classified as members of the industrials sector.

7 The S&P 500 Communication Services Index comprises those companies included in the S&P 500 that are classified as members of the communication services sector.

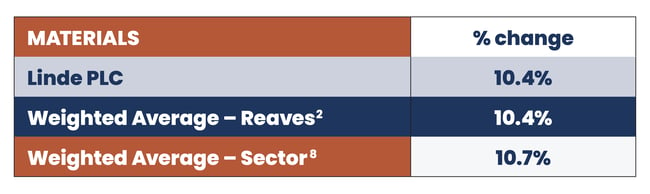

8 The S&P 500 Materials Index comprises those companies included in the S&P 500 that are classified as members of the materials sector.

Weighted average is a calculation that takes into account the varying degrees of importance of the numbers in a data set. In calculating a weighted average, each number in the data set is multiplied by a predetermined weight before the final calculation is made.

Past results do not guarantee future performance. Further, the investment return and principal value of an investment will fluctuate; thus, investor’s equity, when liquidated, may be worth more or less than the original cost. This document provides only impersonal advice and/or statistical data and is not intended to meet objectives or suitability requirements of any specific individual or account.

All investments involve risk, including loss of principal. All data is presented in U.S. dollars.

Cash is cash and cash equivalents.

An investor cannot invest directly in an index.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s own individual circumstances from an independent tax adviser.

Fees: Net performance reflects the deduction of advisory fees which are described in detail in our Form ADV Part 2A.

Please contact your financial professional, or click the following links, for a copy of Reaves’ Form ADV Part 2A and Form CRS.

Additional information about Reaves may be found on our website: www.reavesam.com.

2022 © Reaves Asset Management (W. H. Reaves & Co., Inc.)