At Reaves, we believe one signal of a company’s strength and the durability of future earnings is its ability to grow dividends. And 2021, a year in which the economy rebounded, but inflation and the pandemic remained sources of uncertainty, could offer a good backdrop for how confident the management teams of the companies in our portfolios are about future growth.

It was encouraging to see the majority of our holdings grow their dividends during the year, many at a faster pace than the respective sector average.

In the tables below, we have sorted by sector the companies owned in the Reaves LTV Wrap Composite1, showing dividend growth in the past year, and comparing it to the average dividend growth rate of their respective sector.

In total, 16 of the 18 dividend-paying stocks2 in our portfolio raised their dividend during the period, with two maintaining the same level — Exelon and Shaw Communications. The average weighted dividend increase for the composite was 7.1%.

In aggregate, we believe the dividend growth exhibited by these companies in 2021 speaks to their ability to compound earnings and dividends over time and aligns with the long-term objectives of this investment strategy — to generate both income growth and capital appreciation.

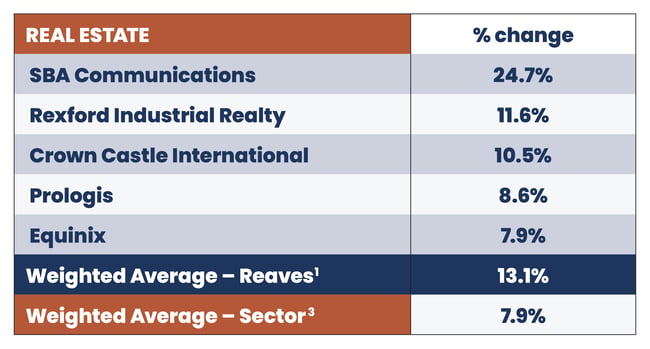

Real Estate

The table below shows the annual dividend increase for each Real Estate stock owned as of December 31, 2021, in a composite of wrap portfolios managed with the Reaves Long Term Value Strategy.

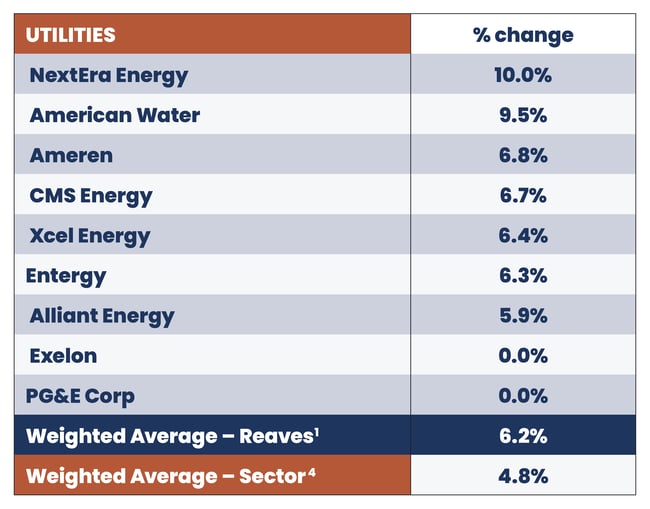

Utilities

The table below shows the annual dividend increase for each Utility stock owned as of December 31, 2021, in a composite of wrap portfolios managed with the Reaves Long Term Value Strategy.

Industrials

The table below shows the annual dividend increase for each Industrial stock owned as of December 31, 2021, in a composite of wrap portfolios managed with the Reaves Long Term Value Strategy.

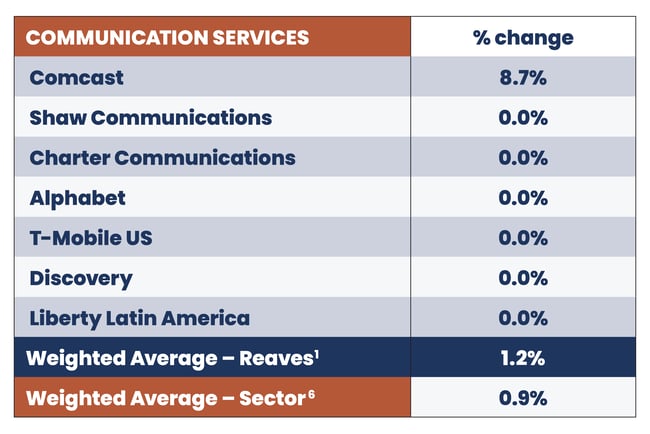

Communications Services

The table below shows the annual dividend increase for each Communications Services stock owned as of December 31, 2021, in a composite of wrap portfolios managed with the Reaves Long Term Value Strategy.

Materials

The table below shows the annual dividend increase for each Materials stock owned as of December 31, 2021, in a composite of wrap portfolios managed with the Reaves Long Term Value Strategy.