As the unemployment rate hit its highest level since the Great Depression (1929-1939), U.S. stock markets recovered roughly half their losses from March’s bear market. If that rally seems unjustified, you aren’t alone. The divergence between stock market performance and economic reality has grabbed a lot of attention in the past couple weeks, but a column in The Economist+ may have described the enigma best, noting that:

“...the mood of markets can shift suddenly, as an extraordinary couple of months has proved. A one-month bear market scarcely seems enough time to absorb all the possible bad news from the pandemic and the huge uncertainty it has created. This stock market drama has a few more acts yet.”

If the market’s next act is another leg down, the previous acts have at least afforded investors opportunity to prepare. Before March’s downturn, advisors had little reason to think about downside protection within their equity portfolios. An 11-year long bull market provided few opportunities to see how client portfolios would weather a downturn.

March’s tumult offered a glimpse of how those portfolios would withstand a market decline, and a rebound has provided a breather to implement changes before another potential fall. Going forward, we believe investors will benefit from including equity strategies that are designed to limit drawdowns.

At Reaves, we have long sought to reduce drawdown risk by focusing our investments on companies that are most essential to the economy. In a recent Q&A, Reaves CEO Jay Rhame explained the approach:

“The consistency of our downside protection comes by design. The types of companies we buy are naturally defensive investments. They provide non-discretionary, essential services with lower risk of earnings declines, even in recession. Investors flock to these sectors in times of uncertainty.”

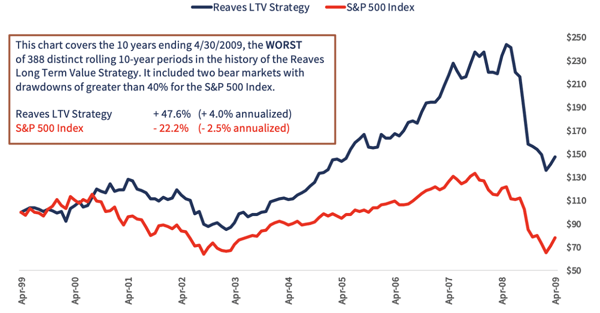

The chart below shows how Reaves’ Long Term Value Strategy held up in one of the worst 10-year market periods in history. The era got off to a decent start before the tech bubble burst, but then included two bear markets and a -22.2% cumulative loss for the S&P 500 index. Through that same time period, Reaves’ Long Term Value Strategy gained 47.6%.

While we don’t know what the market’s next act will be, the dislocation between the market rally and economic reality suggests advisors may want to prepare their clients for another potential decline. We believe our strategies can help.

Data is for the Reaves Asset Management LTV ERISA Composite, net of fees, which ended on 12/20/19.

385 rolling 10-year periods ending Dec 1987 – Nov 2019 = Reaves LTV ERISA Composite*

3 rolling 10-year periods ending Dec 2019 – Mar 2020 = Reaves LTV Wrap Composite**

Reaves LTV ERISA Composite: inception 01/01/78 and ended 12/20/2019

Reaves LTV Wrap Composite: inception 12/31/02

Source: eVestment Analytics

This chart does not represent all periods under management.

See below for additional disclosures and definitions.