In a recent blog post, we wrote about the potential opportunities and risks associated with closed-end funds (CEFs) as well as the characteristics that distinguish CEFs from mutual funds and exchange-traded funds (ETFs). This post will continue that discussion and examine the suitability of CEFs for retirees and other income-oriented investors.

Potential for attractive retirement income

For many retirees focused on finding income investments with attractive yields, the potential appeal of CEFs extends beyond just the current distribution rate. The managed distribution policies utilized by many CEFs may be attractive to investors seeking not just income, but the potential for consistent distributions from their investment portfolio. The laws governing regulated investment companies require mutual funds to distribute nearly all interest and dividend income, together with realized capital gains, each year. However, the timing and amount of payments usually vary and are not always predictable. On the other hand, many CEFs have received an exemption that allows them to make regular fixed payments on a monthly or quarterly basis.

The permanent capital structure of CEFs may also be an advantage to retirees and future retirees, especially during times of market stress. When redemption requests increase, mutual fund and ETF managers are forced to sell securities at depressed prices to meet redemption obligations. In contrast, CEF investors who wish to sell their shares generally cannot redeem those shares directly with the fund, but rather those investors can sell their shares on an exchange to another investor. This allows the fund to remain invested through times of market stress and continue to generate the income retirees often seek.

While these structural characteristics of CEFs are potentially advantageous for retirees and income-seeking investors, not all CEFs are created equal. Before allocating to these funds, investors should evaluate the fund’s underlying assets to determine whether they align with their investment objectives.

Utilities as the backbone of a CEF

The characteristics of utility and utility-like businesses underpin the managed distribution income objectives and long-term investment view that many CEFs and income-oriented investors seek. These include high barriers to entry, limited competition, and the ability to generate consistent, sustainable cash flow through all market cycles to fund dividend and earnings growth. The essential nature of these businesses may allow patient investors to reap the benefits of steady compounding over time.

John Bartlett, co-portfolio manager of the Reaves Utility Income Fund, spoke about the value of utilities within the CEF structure in a recent interview:

“Utilities and other essential infrastructure companies that are monopolies or monopoly-like have a history of producing stable and/or growing earnings and dividends, which complement the CEF structure.” Earnings growth for some of these companies could get an additional boost from the Inflation Reduction Act (IRA) which was passed by Congress last year and includes ambitious carbon emission goal targets and government support from tax credits. With projections that IRA-related tax credits will last 10 to 20 years, John believes utility companies potentially could see annual earnings growth of 5–7% during that stretch.

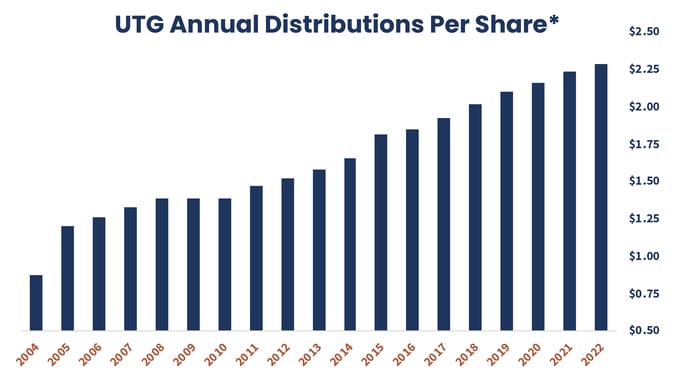

The Fund attempts to build a portfolio of companies that can compound over time, have an attractive yield on cost, and continue to build that income base over time. “The Fund can invest in things that yield a little bit less and grow a little bit more,” John said, adding “Since the Fund’s inception, we’ve never cut its distribution—and we’ve raised it 12 times.”

Income, growth, diversification

For income-seeking investors, CEFs can be a valuable tool. Managed distributions, permanent capital structure, and use of leverage1 are key benefits of these funds. We believe it's important to choose CEFs with underlying assets that can support long-term, managed distributions — much like the utility and essential infrastructure stocks in the Reaves Utility Income Fund have throughout the Fund’s nearly 20-year history.

Visit our blog to learn more about CEFs and for our latest views on utility companies.