The uncertainty caused by the onset of the global pandemic in early 2020 led to weeks of extreme volatility for financial markets and a nearly 20% decline in the S&P 500 Index in the first quarter of 2020. Now, just two years later, investors are confronting another stressful market environment and a new set of concerns including inflation north of 7%, several potential rate hikes by the Federal Reserve, and the outbreak of war in Eastern Europe.

Major stock and bond markets reacted negatively to these developments in the first two months of 2022 with the S&P 500 Index falling by -8.0% and the Bloomberg Barclays U.S. Aggregate Bond Index retreating by -3.2%. The 10-year U.S. Treasury note yield peaked at 2.05% in mid-February before pulling back to 1.83% at month’s end.

Volatile market periods are challenging for many investors and can sometimes lead to poor decisions such as selling near market bottoms. This is one of many reasons why we have always believed defensive equities deserve a place in investors’ portfolios. While 40% exposure to bonds in traditional asset allocation models has historically served a role in dampening portfolio volatility, that bond allocation faces formidable headwinds today due to the onset of inflation.

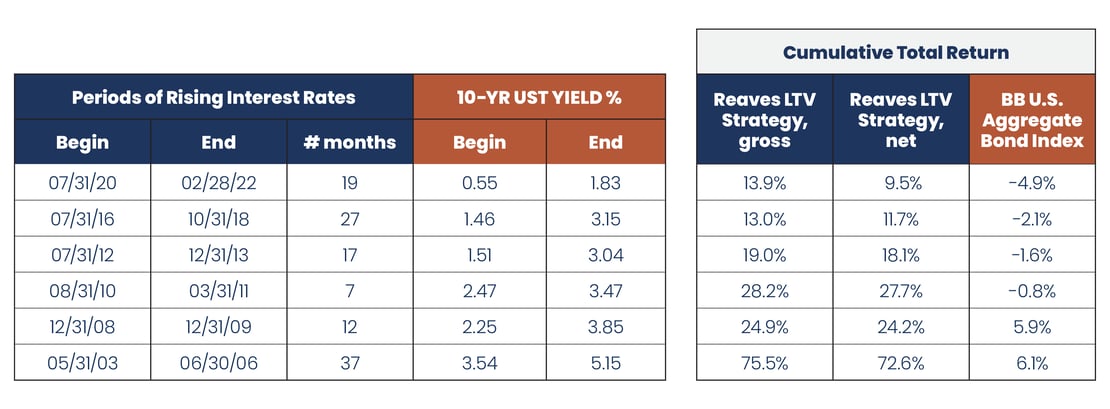

Returns from fixed income investments are likely to be disappointing if rates continue higher. The table below displays the cumulative returns of the Bloomberg Barclays U.S. Aggregate Bond Index in the six rising rate environments since 2001.

Sources: eVestment, U.S. Federal Reserve

For more information, please see our disclosures.

Given prospects for low returns, are fixed income allocations too high?

This is where defensive equities could play a role for investors. By taking a portion of a diversified portfolio’s fixed income allocation and investing it in stocks with defensive characteristics, investors may be able to improve their returns relative to the traditional 60/40 mix, while only slightly altering the portfolio’s risk profile.

We believe our investment strategies deserve consideration in the current market environment. Our own brand of defensive equities – essential service infrastructure stocks – have not only provided defensive characteristics but also may serve as an alternative to bonds in rising rate environments – the key risk facing bonds today.

The table below puts this in perspective, again showing the returns of the Bloomberg Barclays U.S. Aggregate Bond Index alongside the returns of our flagship strategy in each of the rising rate environments that have occurred in the past 20 years.

Sources: eVestment, U.S. Federal Reserve, www.macrotrends.net

*For the period 7/31/20 to 2/28/22, Reaves’ LTV Strategy’s data (gross and net) is represented by our LTV SMA Wrap Composite; and for the period 12/31/77 to 10/31/18, Reaves’ LTV Strategy’s data (gross and net) is represented by our LTV ERISA Composite, which ended 12/20/19.

For more information about our composites, please see our disclosures.

While these tables help tell the story of the potential risk facing fixed income allocations, and how defensive strategies may help, we encourage you to gain further perspective by reading our investment brief, Rethinking 60/40: The Case for Defensive Equities.