As a growing subset of investors look for their assets to achieve both positive returns – and positive societal change – they may want to consider utilities. True, the industry doesn’t currently have the lowest carbon footprint. But perhaps no other sector provides a greater opportunity to have a direct influence on the world, especially as it relates to the environment. We believe this is due in large part to where these businesses are headed and the investments necessary to get them there.

The argument may seem counterintuitive. ESG (Environmental, Social, and Corporate Governance)-labeled strategies, that typically appeal to investors wanting to affect change, tend to own companies that are considered to already have relatively minimal impact on the environment. However, we believe that this group of companies will not necessarily be the ones with the potential and opportunity to improve the quality of the environment in the future.

For utilities, however, the positive future environmental impact is more clear. When investors participate in a utility company’s debt or equity offering, they are often providing capital for that utility to build new wind and solar facilities that will displace fossil-fuel sourced power and, ultimately, make the energy grid greener. We believe that investors who buy and hold utility stocks help play a role in lowering the cost for these companies to raise capital to support renewable investments that will directly reduce their carbon footprints.

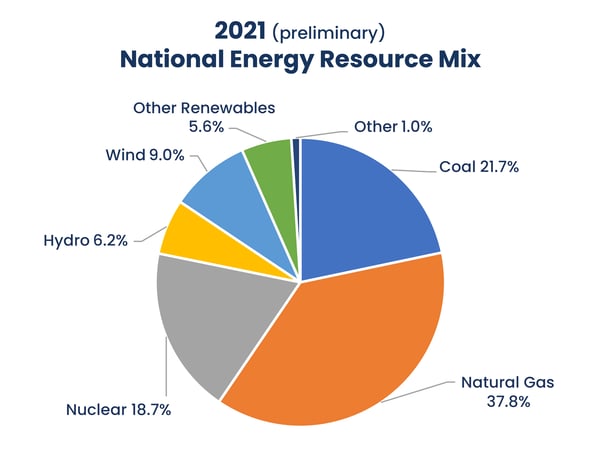

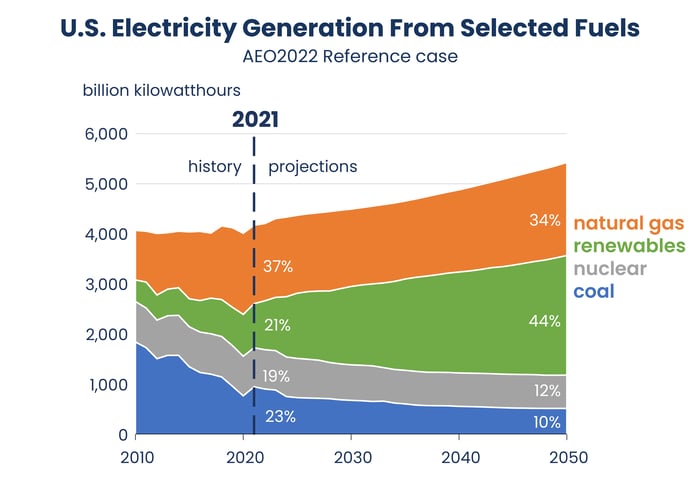

The chart below shows that utility companies utilized wind, hydro, and other renewable sources representing approximately 20% of their power generation needs in 2020. We expect the transition to renewables to accelerate as the U.S. and state governments prioritize clean energy, and as the economics of solar and wind energy generation continue to make them some of the cheapest forms of power in many parts of the U.S. The following chart from the EIA's 2022 Energy Outlook supports our expectations, projecting for renewable energy generation to more than double by 2050 to 44%.

“Other Renewables” includes universal (or large-scale) solar, private (or rooftop) solar, geothermal, and generation from biomass sources (agricultural waste, landfill gas recovery, municipal solid waste, wood, non-wood waste).“Other” includes generation by fuel oil, tires, batteries, chemicals, hydrogen, pitch, purchased steam, sulfur, and miscellaneous technologies.

Link to Source: U.S. Department of Energy, Energy Information Administration; Electric Power Monthly, January 2022; Short-Term Energy Outlook, February 2022

The move toward renewables is the big macro change that utility investors are funding, but many utility companies are also creating other smaller, but still significant, programs and services that will help to reduce future levels of energy consumption.

A few examples include the eventual buildout of electric vehicle charging stations, subsidizing the purchase of energy efficient household appliances, conducting energy audits to help customers identify ways to make their home more energy efficient, and starting initiatives that encourage heat pump installations – a device that lowers household energy use in the summer and winter.

Social and Governance Ratings For Utilities

We believe investors should also feel positive about how utilities screen for the social and governance aspects of their ESG ratings. According to Morningstar, utility companies in the S&P 5001 Index ranked fifth of eleven sectors on social metrics such as workforce diversity, labor relations, and product safety risks.2 Since utilities are often large employers within the communities they serve, and provide a vital service, they are held to high standards by regulators and elected officials.2

In the area of corporate governance, the same group of utility companies in the S&P 500 Index received the second highest rating among the eleven industry sectors.2 Governance covers a variety of areas including a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

With the environmental changes that utilities enable, and the social and governance improvements they support, we believe there are scant places investors can put their money and see it drive greater positive change.

The growing stream of dividend income from many utility companies is, of course, another reason we continue to remain invested in this sector.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

Reaves Asset Management does not currently provide an ESG strategy.

1 The S&P 500 Index (“S&P 500”) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The typical Reaves portfolio includes a significant percentage of assets that are also found in the S&P 500. However, Reaves’ portfolios are far less diversified, resulting in higher sector concentrations than found in the broad-based S&P 500.

2 Source of Charts Below: Morningstar as of 12/31/20

| Sector ETFs | Environmental | |

| Communication Services Select Sector SPDR | XLC | 1.13 |

| Financial Select Sector SPDR | XLF | 1.23 |

| Technology Select Sector SPDR | XLK | 1.67 |

| Health Care Select Sector SPDR | XLV | 1.77 |

| Consumer Discretionary Select Sector SPDR | XLY | 3.87 |

| Real Estate Select Sector SPDR | XLRE | 4.53 |

| Consumer Staples Select Sector SPDR | XLP | 7.17 |

| Industrial Select Sector SPDR | XLI | 7.68 |

| Materials Select Sector SPDR | XLB | 12.07 |

| Utilities Select Sector SPDR | XLU | 14.63 |

| Energy Select Sector SPDR | XLE | 16.42 |

| Average | 6.56 |

| Sector ETFs | Social | |

| Real Estate Select Sector SPDR | XLRE | 4.52 |

| Utilities Select Sector SPDR | XLU | 6.63 |

| Materials Select Sector SPDR | XLB | 8.04 |

| Consumer Staples Select Sector SPDR | XLP | 9.7 |

| Industrial Select Sector SPDR | XLI | 10.35 |

| Technology Select Sector SPDR | XLK | 10.44 |

| Consumer Discretionary Select Sector SPDR | XLY | 10.78 |

| Energy Select Sector SPDR | XLE | 10.79 |

| Health Care Select Sector SPDR | XLV | 11.62 |

| Communication Services Select Sector SPDR | XLC | 12.75 |

| Financial Select Sector SPDR | XLF | 14.6 |

| Average | 10.02 |

| Sector ETFs | Governance | |

| Real Estate Select Sector SPDR | XLRE | 5.12 |

| Utilities Select Sector SPDR | XLU | 5.85 |

| Materials Select Sector SPDR | XLB | 5.88 |

| Consumer Staples Select Sector SPDR | XLP | 6.12 |

| Industrial Select Sector SPDR | XLI | 6.77 |

| Technology Select Sector SPDR | XLK | 6.78 |

| Consumer Discretionary Select Sector SPDR | XLY | 7.18 |

| Energy Select Sector SPDR | XLE | 7.56 |

| Health Care Select Sector SPDR | XLV | 8.9 |

| Communication Services Select Sector SPDR | XLC | 9.77 |

| Financial Select Sector SPDR | XLF | 10.85 |

| Average | 7.34 |

Past results do not guarantee future performance. Further, the investment return and principal value of an investment will fluctuate; thus, investor’s equity, when liquidated, may be worth more or less than the original cost. This document provides only impersonal advice and/or statistical data and is not intended to meet objectives or suitability requirements of any specific individual or account.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Cash is cash and cash equivalents.

An investor cannot invest directly in an index.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s own individual circumstances from an independent tax adviser.

Fees: Net performance reflects the deduction of advisory fees which are described in detail in our Form ADV Part 2A.

Please contact your financial professional, or click the following links, for a copy of Reaves’ Form ADV Part 2A and Form CRS .” Additional information about Reaves may be found on our website: www.reavesam.com.

2022 © Reaves Asset Management (W. H. Reaves & Co., Inc