Disclosures and Definitions:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

The term active management implies that a professional money manager or a team of professionals is tracking the performance of a client's investment portfolio and regularly making buy, hold, and sell decisions about the assets in it.

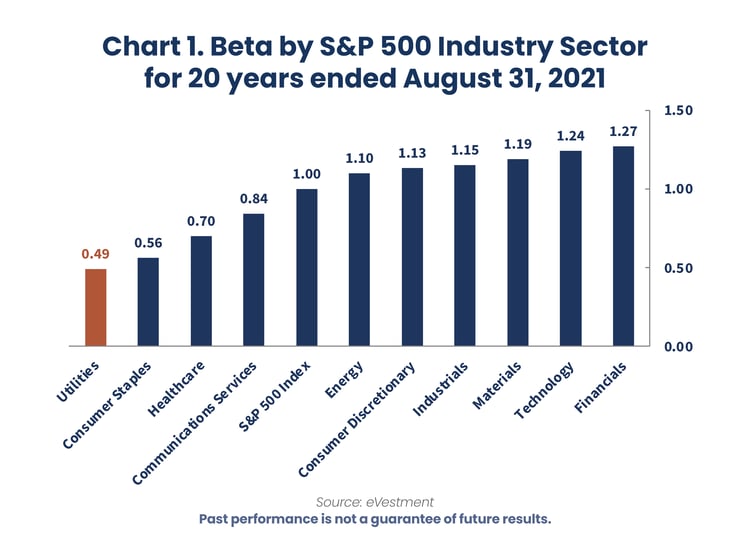

Beta measures a stock’s volatility relative to the broad market. A stock with a beta higher than 1.0 has historically been more volatile than the market, while a stock with a beta lower than 1.0 has been less volatile.

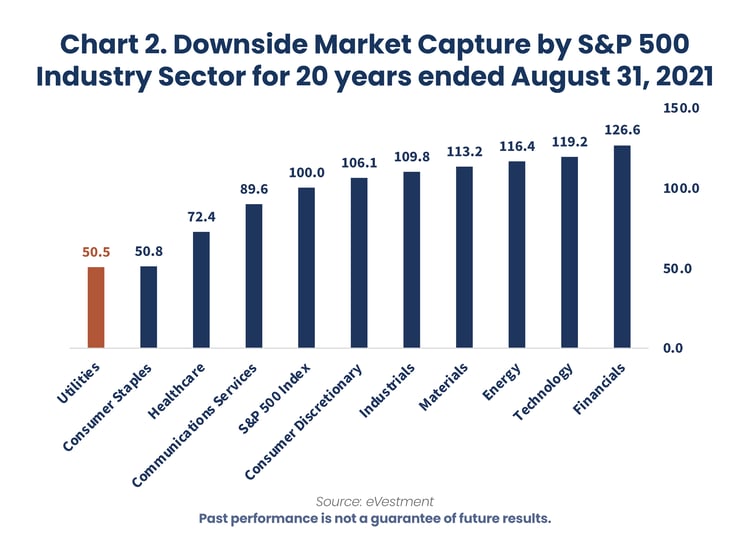

The Downside Capture Ratio is the ratio of the manager’s overall performance to the benchmark’s overall performance, considering only quarters that are negative in the benchmark.

The long-term capital expenditure cycle occurs when the large capital assets of a company go through the entire duration of their lifespan.

The S&P 500 Index (“S&P 500”) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The typical Reaves portfolio includes a significant percentage of assets that are also found in the S&P 500. However, Reaves’ portfolios are far less diversified, resulting in higher sector concentrations than found in the broad-based S&P 500.

The inception date of Virtus Reaves Utilities ETF (UTES) is September 23, 2015.

Risk Considerations: Exchange-Traded Funds (ETF): The value of an ETF may be more volatile than the underlying portfolio of securities it is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities. Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk. Utilities Sector Concentration: The fund’s investments are concentrated in the utilities sector and may present more risks than if the fund were broadly diversified over numerous sectors of the economy. Market Volatility: Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events could have a significant impact on the fund and its investments, including hampering the ability of the fund’s portfolio manager(s) to invest the fund’s assets as intended. Prospectus: For additional information on risks, please see the fund’s prospectus.

Past performance is not a guarantee of future results.

Please consider a Fund’s investment objectives, risks, charges, and expenses carefully before investing. For this and other information about any Virtus Fund, contact your financial professional, call 800-243-4361, or visit virtus.com for a prospectus or summary prospectus. Read it carefully before investing.

Not insured by FDIC/NCUSIF or any federal government agency. No bank guarantee. Not a deposit. May lose value.

ETFs distributed by VP Distributors, LLC, member FINRA and subsidiary of Virtus Investment Partners, Inc.

Past results do not guarantee future performance. Further, the investment return and principal value of an investment will fluctuate; thus, investor’s equity, when liquidated, may be worth more or less than the original cost. This document provides only impersonal advice and/or statistical data and is not intended to meet objectives or suitability requirements of any specific individual or account.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Cash is cash and cash equivalents.

An investor cannot invest directly in an index.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s own individual circumstances from an independent tax adviser.

Fees: Net performance reflects the deduction of advisory fees which are described in detail in our Form ADV Part 2A.

Please contact your financial professional, or click the following links, for a copy of Reaves’ Form ADV Part 2A and Form CRS.

Additional information about Reaves may be found on our website: www.reavesam.com.

2021 © Reaves Asset Management (W. H. Reaves & Co., Inc.)