Energy transition, the ongoing transformation of global energy generation from fossil-based to renewables-based, and its implications for the utilities sector is a long-term theme discussed regularly at Reaves. The generation of electricity has historically been one of the world’s largest sources of carbon emissions due to its reliance on fossil fuels, such as coal and natural gas.

We believe a shift in global carbon emission policies over the last decade and the enaction of aggressive timelines to reach zero-carbon goals have encouraged utility companies to invest heavily in both wind and solar generation projects. As discussed in a prior blog, we believe this energy generation transition will be a multi-decade process with positive benefits for the environment and for many constituencies, including the shareholders of utility stocks.

In addition to wind and solar project opportunities, utility companies continue to innovate and search for other scalable renewable energy solutions.

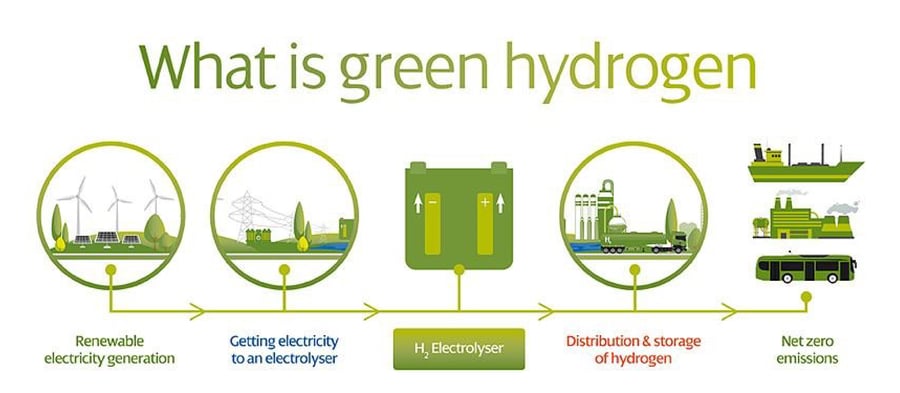

What Is Green Hydrogen?

Hydrogen, the most abundant element on earth, can be extracted through the electrolysis of water – a process which uses an electric current to break water into its component elements of hydrogen and oxygen. When the electricity used in this process comes from a renewable source, such as a wind turbine, the clean hydrogen produced is referred to as green hydrogen.

Since not all industrial processes can be decarbonized through electrification, green hydrogen is viewed as a potential low-carbon fuel that could serve as a substitute for the fossil fuels in use today.

Source: Stuart Mitchell, “ScottishPower Sets Sights on Green Hydrogen Revolution.” Ethical Marketing News, March 2, 2021.

Utility Companies and Green Hydrogen

We are seeing an increasing number of announcements from the utility companies we follow related to green hydrogen.

New Jersey Resources (NJR)

Last month NJR became the first gas utility operator to blend green hydrogen into its distribution system as part of its early efforts to deliver decarbonized fuels and reduce carbon emissions.

NJ Resources green hydrogen blending project1

Sempra Energy (SRE)

In July 2021, SRE subsidiary Southern California Gas announced various initiatives to accelerate low-cost, clean hydrogen innovations.

So Cal Gas transformative hydrogen technologies2

NextEra Energy (NEE)

On its October 2021 earnings call, NEE announced plans to build a 500-megawatt wind project with the majority of the power contracted to a hydrogen fuel cell company which intends to construct a nearby hydrogen electrolyzer facility. The hydrogen manufactured by the facility will enable commercial and industrial end-users to transition to emissions-free green hydrogen.

NextEra Energy wind project for green hydrogen3

Xcel Energy (XEL)

On its October 2021 earnings call, XEL said the company, which currently is conducting a hydrogen pilot project at one of its nuclear power plants, is “exploring five to eight additional greenfield and brownfield hydrogen projects.”

Xcel Energy comments on hydrogen projects4

Large Oil Companies & Green Hydrogen

At the recent COP26 Climate Summit in Glasgow, 28 companies including major oil companies BP and Royal Dutch Shell, “launched a new global initiative to accelerate the replacement of highly polluting grey hydrogen with lower-carbon hydrogen.” The link below is to an article which lists the pledges made by each of the 28 companies to accelerate the demand and/or supply of low-carbon hydrogen:

COP26 pledges by major energy companies5

In Summary

We are closely monitoring these ongoing developments related to green hydrogen as we believe it is another potential source of future growth for utility companies as it relates to renewable energy transition and global carbon reduction.