When it comes to investing in the trend of electric vehicle (EV) adoption, there are plenty of winners and losers that still need to shake out. The optimal engine designers, battery technology developers, vehicle manufacturers and charging station producers is still ever changing, as are the valuations of the companies supporting them.

At Reaves, we believe two things appear certain as it relates to electric vehicles: more are coming, and those vehicles will require power to charge them. Those basics are two reasons utility companies may be a predictable way to invest in the electric vehicle adoption trend, but there is another potential reason investors might not expect.

Yes, electric vehicles will likely increase load growth for many utilities. In fact, the United States Department of Energy estimates that electrical demand could increase by as much as 38% by 2050.1 Load growth benefits utilities by increasing the sale of megawatts on their networks and in turn increases revenue. However, we believe electric vehicles will also necessitate an increase in utility service-related capital expenditures to support their widespread adoption.

Industry estimates support this theme. For example, utility company Xcel Energy estimates its investment cycle to cater to electric vehicle demand will be massive, requiring $2 billion investment in service connections, charging infrastructure and related programs.2

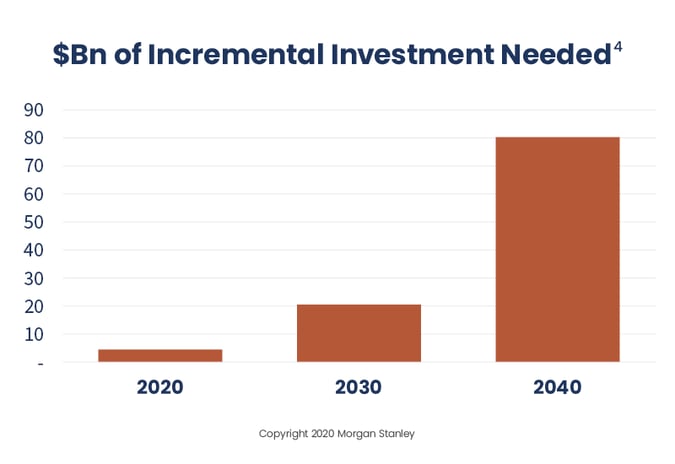

Additionally, a recent Morgan Stanley report estimates: “The U.S. currently has 12% of the chargers it will need by 2030, and 4% of the chargers it will need to support 64 million BEVs on the road by 2040. Meeting this gap will require $21 billion and $80 billion of investment in charging infrastructure by 2030 and 2040 …”3

Clearly, utilities will need to make considerable investments to accompany electric vehicle adoption. Those investments aren’t limited to simply connecting public electric vehicle charging stations though. Utilities will have to harden their networks to ensure they are resilient enough to handle the demand shift of, for example, half the families in a neighborhood charging their car overnight.

We believe these investments should be positive for earnings. We’ve explained the utility earnings model in a prior blog, but for those unfamiliar, higher capital expenditures tend to increase earnings power for utilities companies.

This is because utilities are allowed to earn a set rate of return on the amount of invested capital they deploy. When they deploy capital to accommodate a trend such as electric vehicle adoption, regulators tend to view the investment cycle favorably, and approve changes to utility companies’ rate base that allows them to grow earnings.

Other ‘Green’ Trends Benefit Utilities

As we’ve mentioned in another prior blog, utilities are a key beneficiary of the shift toward renewable energy sources. Many companies are shutting down existing coal and nuclear plants and making major investments to utilize cheaper wind and solar energy to supply power to customers.

The shift toward electric vehicles is yet another green trend that presents long-term growth opportunities for utilities over the next decade.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1https://afdc.energy.gov/files/u/publication/electrification_futures_study.pdf (Page xiv)

2http://investors.xcelenergy.com/Cache/IRCache/d772e07d-8149-d9a3-86e1-0c4eb139233a.PDF?O=PDF&T=&Y=&D=&FID=d772e07d-8149-d9a3-86e1-0c4eb139233a&iid=4025308. As of 9/30/20, Xcel Energy was widely held in Reaves’ portfolios.

3Utilities: The Unintended Bottleneck to Mass EV Penetration? Byrd, Stephen, Morgan Stanley Research, 10/25/20. Copyright 2020 Morgan Stanley. (Page 10)

4Utilities: The Unintended Bottleneck to Mass EV Penetration? Byrd, Stephen, Morgan Stanley Research, 10/25/20. Copyright 2020 Morgan Stanley. (Page 2)

Past performance is no guarantee of future results.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax adviser.