Utility and utility-like stocks have formed the foundation of our managed portfolios over the past 45 years. These essential infrastructure businesses, we believe, possess characteristics such as high barriers to entry, limited competition, consistent and durable cash flow generation, small risk of bankruptcy or obsolescence, and the ability to grow earnings and dividends in all market cycles.

Many of these investment characteristics can be found in data centers – physical facilities that host and interconnect the mission-critical infrastructure required to connect networks, store and process data, and provide a digital on-ramp to cloud applications.

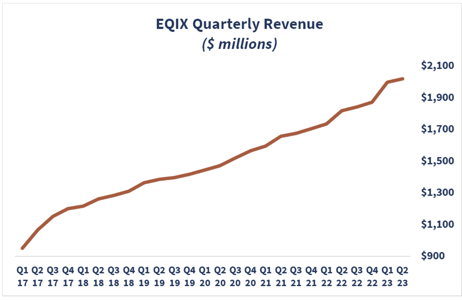

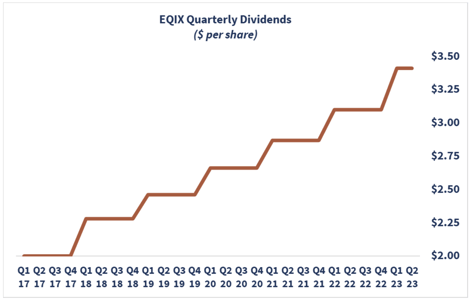

Equinix (EQIX), the largest publicly traded, pure play data center company, houses many of the world’s most critical network exchange points, engendering powerful network effects across industry verticals and horizontals. An Equinix facility often provides the shortest, fastest, and safest connection to a telecom network. Its customer base is highly diversified across industries and geographies. The results the company has delivered, including more than a two-decade run of quarterly revenue growth that is the longest in the S&P 5001, tend to be steady and durable. The charts below highlight the company’s revenue and dividend growth over the last six years.

Source: Equinix

We expect these trends in revenue and dividend growth to continue due to “data gravity,” an industry term referencing the correlation between the growth of data sets and the proliferation of their applications. Use case growth attracts additional applications and services. This virtuous, digital cycle is often housed within Equinix facilities. The company’s management, in an investor presentation earlier this year, discussed how the adoption and expansion of artificial intelligence (AI) workloads may have the potential to benefit from this very dynamic. Current expectations, however, are that AI workloads will initially be trained in less differentiated, hyperscale facilities before they are ready for the prime locations operated by Equinix. In the interim, the megatrend of cloud-native applications is driving demand for Equinix’s real estate endures. The combination of cloud today and AI tomorrow illustrates what we believe is a favorable long-term story for the company.

Source: Equinix Investor Presentation, Q2 2023

Growth in data center usage also has potential implications for electricity consumption. The equipment housed in the centers generates significant heat, requiring operators like Equinix to constantly cool their facilities to maintain the optimum temperature. Power needs are increasing to keep pace with growth. Recently, Dominion Energy, the utility which provides power in Northern Virginia, where many of the largest data centers are located, made a regulatory filing detailing increases in its long-term forecast of electricity demand. These higher forecasts were prompted by long-term power agreements being signed with data centers. Dominion stated that the strong demand will potentially triple the current level of demand to 5% annually sometime in the next 15 to 25 years.

Reaves began investing in data centers in 2018, attracted to the characteristics of the business. The continued migration of enterprises to cloud computing, in addition to the potential tailwinds from AI, are why we have maintained our optimism in this market segment. These utility-like businesses offer the steady revenue and dividend growth we seek, and their increasing electricity consumption offers another potential reason to be enthused about our core electric utility holdings.