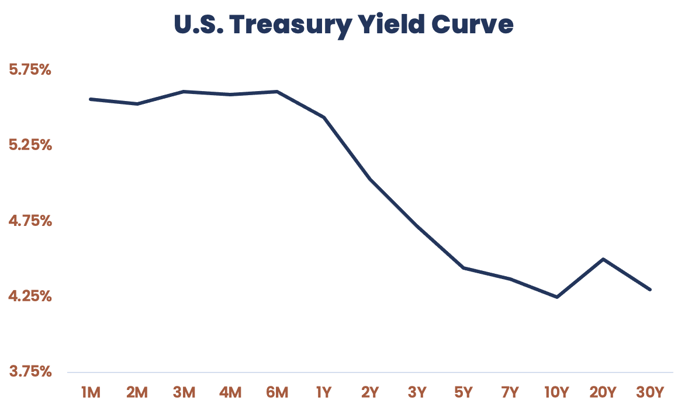

Often considered a recessionary indicator, the U.S. Treasury yield curve remains inverted with the short end offering a yield of over 5.5% and the 10-Year Treasury note over 4.2%. The 3-month Treasury bill yield has moved to over 5.6% compared to a year ago at 2.41% and two years ago at 0.06%. This high yield environment is usually a headwind for utility stocks, and that has been true year-to-date, with the sector posting its worst first half performance relative to the S&P 500 Index in 35 years.

As of 8/25/23

Source: Bloomberg

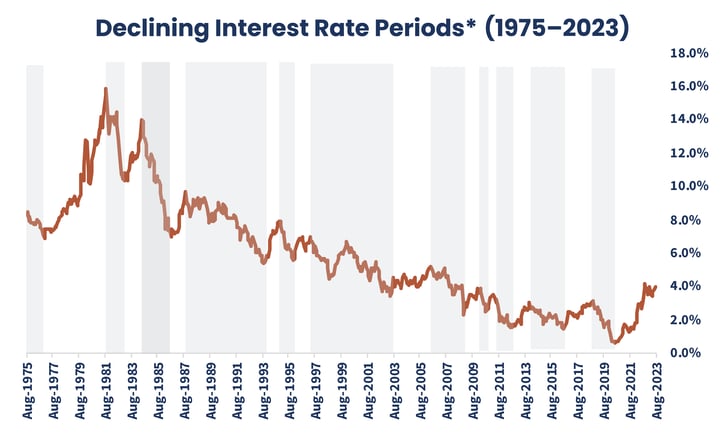

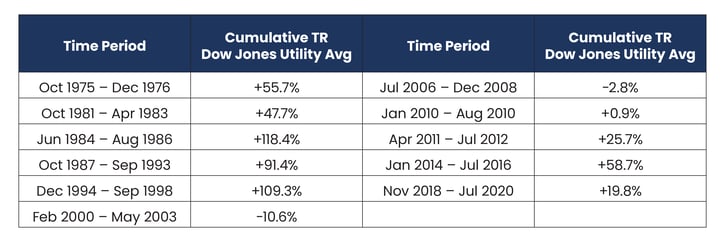

However, if interest rates do decline, the utility sector should be poised for positive returns. Since 1975 there have been 11 periods of falling rates as measured by the 10-Year U.S Treasury yield. During those periods utilities had a positive total return 9 of 11 times. Exceptions were the bear market at the beginning of the century after the dot-com bubble burst and the great financial crisis. During those same periods utilities beat the S&P 500 in 8 of the 11 periods. More recently, in the six falling rate periods since 2000, utilities outperformed the S&P 500 in five of six instances and were only slightly behind in the one period of underperformance.

*Yield on the U.S. 10-Year Treasury Note

*Yield on the U.S. 10-Year Treasury Note

Source Bloomberg

The current narrative on the health of the U.S economy and the direction of interest rates continues to fluctuate. The Fed has raised interest rates by more than five percentage points over the past two years in an attempt to reign in the highest inflation the country has seen in decades. This rapid change in rate policy has seemingly been successful bringing Inflation closer to the Fed’s 2% target. The latest Consumer Price Index (CPI) data showed inflation has declined from over 9% in July of last year to 3.2% today. And the economy continues to grow. Last week’s 2Q Gross Domestic Product (GDP) report showed the country expanding at over 2.4% annually, albeit slightly lower than the prior quarter’s 2.6% result. Personal income data, however, showed wages grew at a slower pace than in the prior quarter, spurring questions as to the sustainability of GDP expansion going forward.

Chairman Powell cooled market sentiment that the Fed could cut rates this year at his latest press conference, stating “the process of getting inflation back down to 2% has a long way to go. Despite elevated inflation, longer term inflation expectations appear to remain well anchored.” At the same time Fitch downgraded the credit rating of the United States to AA+ from AAA, citing ballooning U.S debt load. The company expects the country to enter a recession by year end.

We believe clarity over the direction of interest rates and the health of the economy likely continues to be unclear. If investors believe we are at or close to peak rates then utilities, a defensive equity allocation with resilient fundamentals in all market cycles, may rally. At Reaves, we analyze utilities from the bottom-up, taking our cues from company fundamentals and regulatory environments to pick our best ideas. We consider the macroeconomic landscape when constructing portfolios but avoid making interest rate projections. Forecasting is extremely difficult to consistently get right, we prefer to focus on the stocks.

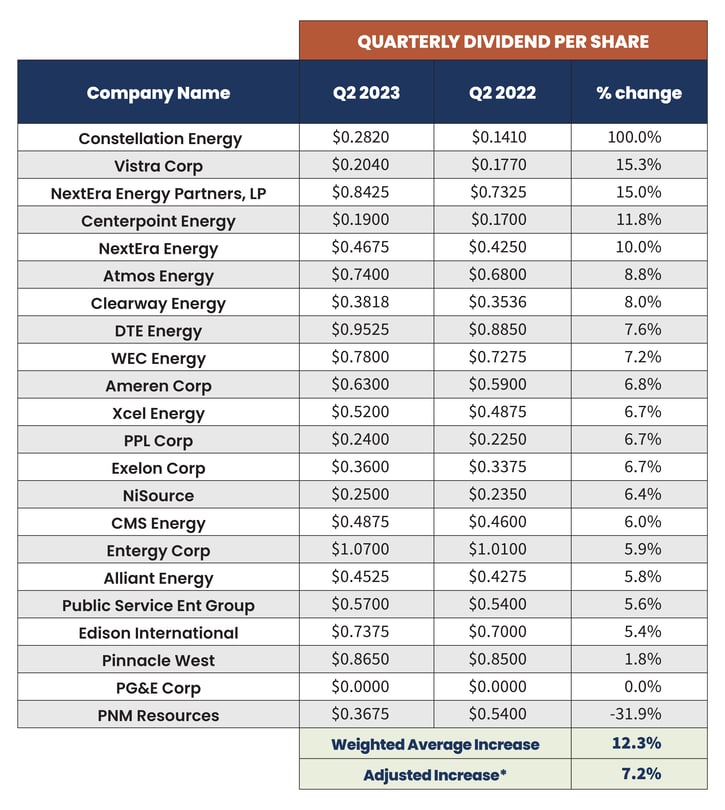

The trajectory of both earnings and dividend growth is one of the first factors we look at when building the portfolio of our actively managed Virtus Reaves Utilities EFT (UTES). Within the fund, earnings are expected to grow by nearly 9% this year. Dividend growth, an indicator we watch closely to assess management’s confidence in a company’s financial strength, has grown by 12.3% from this time last year. One holding, Constellation Energy Group (CEG), raised its dividend 100% in the period (excluding that outlier, UTES’ portfolio dividend growth is still over 7%).

Source: Bloomberg

Source: Bloomberg

*Excludes highest (Constellation Energy +100.0%) and lowest (PNM Resources -31.9%).