One of the major talking points between presidential candidates and political pundits this election cycle has been the potential for a corporate tax hike under a Biden presidency. If a tax hike does come to fruition, utility stocks may be better positioned than other sectors to absorb it.

This is because the regulated utility business model allows companies to pass the costs of higher taxes onto the customer. So, all things being equal, the tax increase won’t affect earnings per share.

When tax consequences are reflected in stock prices the change can be meaningful. And markets have rewarded – or punished – utility stocks accordingly when tax news moves markets.

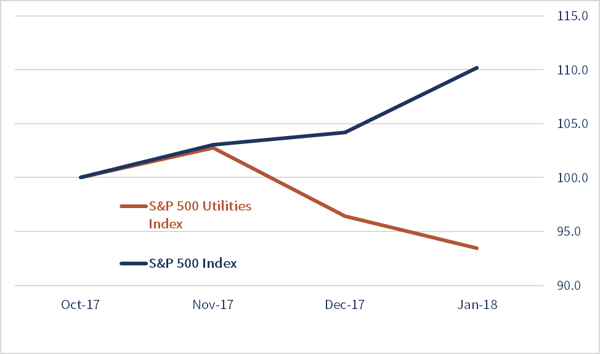

We saw this in early November 2017, when President Trump introduced tax cuts to Congress and signed them into law in late December that same year. During this time, the broader S&P 500 Index1 outperformed the utilities sector2 as the market digested the concept that other non-utilities companies would receive an earnings boost from tax cuts that utilities would not.

Utilities Sector Performance

(3 Months ended 1/31/2018)

Source: Bloomberg

Now, if corporate taxes increase, we would expect the market to reflect the fact that utilities would be better positioned than other sectors to absorb it. It will be something to keep an eye on as November approaches.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

1The S&P 500 Index (“S&P 500”) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The typical Reaves portfolio includes a significant percentage of assets that are also found in the S&P 500. However, Reaves’ portfolios are far less diversified, resulting in higher sector concentrations than found in the broad-based S&P 500.

2 The S&P 500 Utilities Index is a capitalization-weighted index containing electric and gas utility stocks (including multiutilities and independent power producers). Prior to July 1996, this index included telecommunications equities.

Past performance is no guarantee of future results.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax adviser.