Stocks have enjoyed a strong rebound since late March, with major U.S. indices clawing back most of their first-quarter losses. The NASDAQ even hit new record highs and closed above 10,000 for the first time last week.

If you feel like the rally may be overdone, you are not alone. We made the case in a blog post several weeks ago that the rebound seemed out of touch with economic reality. However, we are not market timers and are not going to call whether markets will take another leg down. But with many people questioning what might be ahead given the economic uncertainty, we have a message we thought was worth sharing: Stay invested.

One of our key messages to clients is that time in market creates value in market. This seems to be true of equities, in general, but we believe it is particularly true for our Long Term Value Strategy. At Reaves, we pour our research efforts into identifying steady, growth companies whose services lay at the very foundation of modern society. Finding – and holding – these companies over long periods as they consistently compound earnings and dividends is a key feature of our strategy.

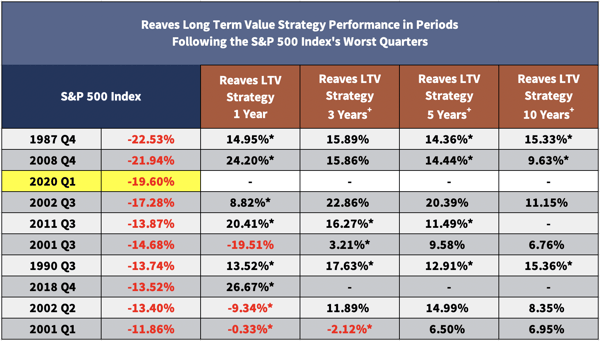

The chart below makes the case for staying the course. It shows the annualized returns of Reaves’ Long Term Value Strategy in the one-, three-, five- and 10-year periods following the worst quarters of performance for the S&P 500 since the inception of the Strategy.

For further perspective on long-term investing, since 1978, Reaves’ Long Term Value Strategy has generated positive total returns in 99.8% of 445 distinct five-year rolling time periods. (Please see disclosures).

The bottom line: We believe, if stocks do take another turn down, or even if the rebound continues, you should stay the course.

+Annualized

*Reaves Long Term Value Strategy performance lagged the S&P 500 Index

Performance is based on Reaves LTV ERISA Composite through November 2019 (the composite ended on 12/20/19).

Performance is based on Reaves LTV Wrap Composite beginning December 2019.

This table does not represent performance for all periods under management.

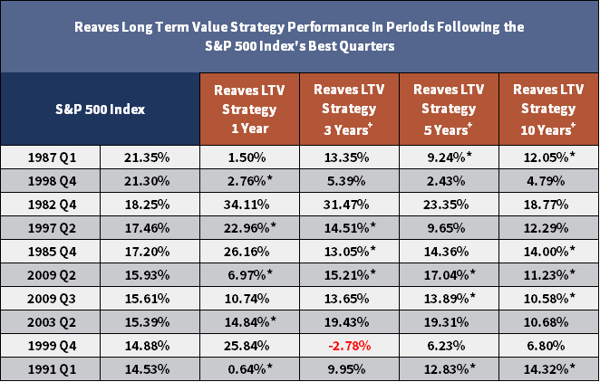

If you would like to see how the Reaves Long Term Value Strategy performed in multiple time periods following the highest quarterly returns of the S&P 500 Index since 1978, please see Chart 1 in the footnotes below.

Disclosures:

Reaves Asset Management is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any skill or training. Reaves is a privately held, independently owned “S” corporation organized under the laws of the State of Delaware.

The information provided in this blog does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. Investors should consider the investment objective, risks, charges and expenses of all investments carefully before investing. Any projections, outlooks or estimates contained herein are forward looking statements based upon specific assumptions and should not be construed as indicative of any actual events that have occurred or may occur.

+Annualized

*Reaves Long Term Value Strategy performance lagged the S&P 500 Index

Performance is based on Reaves LTV ERISA Composite through November 2019 (the composite ended on 12/20/19).

This table does not represent performance for all periods under management.

Reaves’ Long Term Value Strategy (Reaves LTV Strategy) seeks a high risk-adjusted total return. The strategy tends to be invested in relatively larger companies with strong balance sheets, good cash flow and a history of dividend growth. Core positions are accumulated in financially strong, high-quality companies and generally have the following characteristics: strong management, above industry-average growth rates, large/mid-market capitalization and low price-earnings multiples.

Reaves performance data is the Reaves LTV ERISA Composite and, unless otherwise noted, all data is net of fees. The Reaves LTV ERISA Composite reflects the dollar-weighted return of all corporate ERISA pension accounts with assets of at least $1,000,000 under management for all periods presented (the minimum was $900,000 during the period 08/31/10-06/22/12). Returns are time-weighted and include the reinvestment of all dividends and other earnings, net of commissions. The LTV ERISA Composite does not reflect all of the Reaves’ assets under management. The LTV ERISA Composite began on 1/1/78 and ended on 12/20/19.

Beginning December 2019, Reaves LTV Strategy is represented by the LTV SMA Wrap Composite. This composite contains those LTV discretionary portfolios with wrap (bundled) fees. Wrap accounts are charged a bundled fee which includes the wrap sponsor fee, as well as, Reaves’ investment advisory fee. Due to compliance requirements, the net-of-fees calculation is computed based on the highest annual fee assigned by any wrap sponsor who utilizes this portfolio in an investment wrap program (300 basis points from 1/1/03 through 12/31/16 and, effective 1/1/17, 250 basis points). The LTV SMA Wrap Composite performance consists of money-weighted, time-weighted returns and it includes the reinvestment of all dividends and other earnings. The inception date of the composite is December 2002; however, the composite was created in January 2013. This composite has been managed in a similar manner to the LTV ERISA Composite which ended in December of 2019. The LTV SMA Wrap Composite does not represent all of Reaves’ assets under management.

Rolling returns reflect the cumulative return on a continuously held investment over a number of consecutive periods, calculated monthly.

NASDAQ is a global electronic marketplace for buying and selling securities.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The typical Reaves portfolio includes a significant percentage of assets that are also found in the S&P 500. However, Reaves’ portfolios are far less diversified, resulting in higher sector concentrations than found in the broad-based S&P 500 Index.

Past performance is no guarantee of future results.

All investments involve risk, including loss of principal.

All data is presented in U.S. dollars.

Important Tax Information: Reaves Asset Management and its employees are not in the business of providing tax or legal advice to taxpayers. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax adviser.

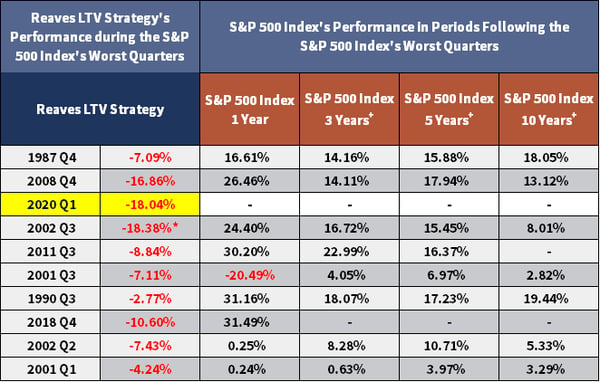

Supplemental Information:

+Annualized

*Reaves Long Term Value Strategy performance lagged the S&P 500 Index

Performance is based on Reaves LTV ERISA Composite through November 2019 (the composite ended on 12/20/19).

Performance is based on Reaves LTV Wrap Composite beginning December 2019.

This table does not represent performance for all periods under management.

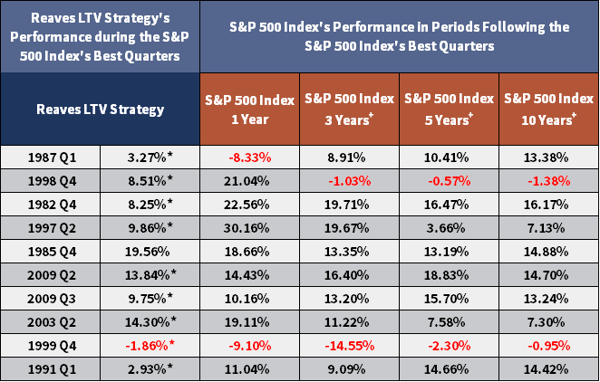

+Annualized

*Reaves Long Term Value Strategy performance lagged the S&P 500 Index

Performance is based on Reaves LTV ERISA Composite through November 2019 (the composite ended on 12/20/19).

This table does not represent performance for all periods under management.