Not surprisingly, higher beta, growth-oriented stocks and sectors have performed very strongly1 in what’s largely been a bull market environment since the end of the financial crisis in early 2009. But now is not the time to discount the role of certain defensive equities in a diversified portfolio.

A longer look back at markets shows low beta defensive equities delivered very similar performance to high beta sectors … but with a less bumpy ride.

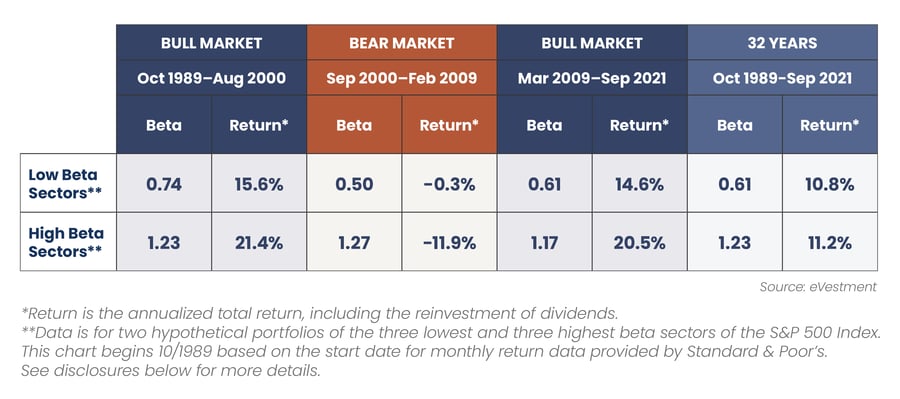

The table below puts this in perspective. Over the past 32 years, the three lowest beta sectors2, which we use as a proxy3 for defensive equities, trailed the three highest beta sectors4 by a small margin, with an annualized return of 10.8% for the defensive group and 11.2% for the high beta group.

Most significantly, the two groups arrived at those returns quite differently. We segmented the market environments of the past three-plus decades into two largely bull market periods and one largely bearish period.

The difference in performance during the bear market segment shown above is striking, and highlights why investors should regularly review the level of risk being carried in their equity holdings. The cumulative total return of the high beta sectors in the 8 ½ year period from September 1, 2000 to February 28, 2009, was -65.9% compared to -2.3% for the more defensive, low beta sectors.

Putting it All Together

In our blog post last month entitled Reconsidering 60/40, we encouraged investors to consider shifting some of their fixed income allocation into defensive equity strategies, a change which would, at the margin, increase the overall level portfolio risk in the search for higher returns.

In this post, we share over three decades of data to demonstrate that attractive, competitive investment returns in equities are possible to achieve without taking on excessive risk.

In our example, the three sectors of the S&P 5005 with the lowest beta had only slightly lower returns over the past 32 years than the three highest beta sectors — and these returns were generated with less than half the risk — beta of 0.61 versus 1.23, respectively. Defensive, low beta equities provided quite a different experience for investors in terms of volatility, especially during the challenging period from September 2000 to February 2009 for U.S. equity markets.

We believe that there are clear benefits from having a portion of your equity allocation dedicated to low beta, defensive investment strategies. We encourage investors to examine the amount of risk in their portfolios and to review some of the strategies offered by Reaves Asset Management which can be found on our website at www.reavesam.com.