The adoption of artificial intelligence (AI) and its potential use cases was a major theme for investors in 2023. Applications such as Open AI, IBM Watson, and Google’s Bard have rapidly expanded generative AI use for both individuals as well as corporations. In fact, McKinsey’s recently published Global Survey found that one-third of the respondent organizations are using AI for at least one business function, and 40 percent of the respondents expect their organizations to increase their AI investments.

A window into anticipated growth

Look no further than the stock performance of the companies providing the chips and processing required to support AI to understand the expected growth of these applications. The scale of digital infrastructure required to sustain the expansion and anticipated future growth of AI is still somewhat unclear. However, data centers will play a pivotal role in facilitating this growth, proving to be indispensable for its advancement.

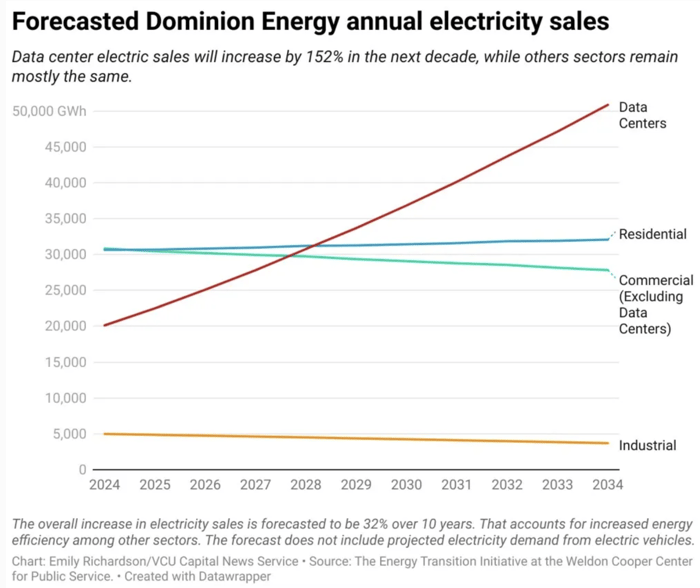

As we discussed in a recent blog post, growth in data center usage has potential positive implications for electricity consumption and our investments in the utility space. The servers housed in data centers generate significant heat, requiring operators to constantly cool their facilities to maintain the optimum temperature. Power needs will likely increase to keep pace with expected cloud services and AI growth.

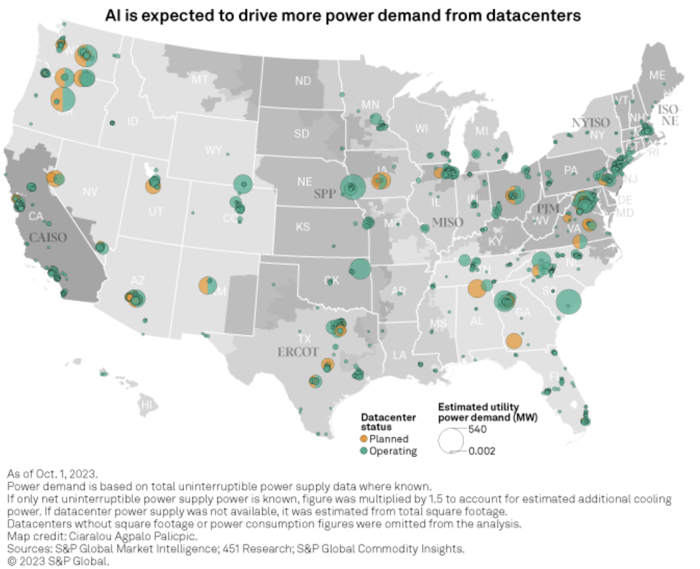

Data center electric consumption growth has been notable to long-time utility observers. The current market commands about 40 GW of electricity and represents about 3% of U. S. load. In the last 90 days, we believe that number likely grew another 5%. We expect electricity consumption by data centers to continue growing at about 20% annually.

Signs of a power surge

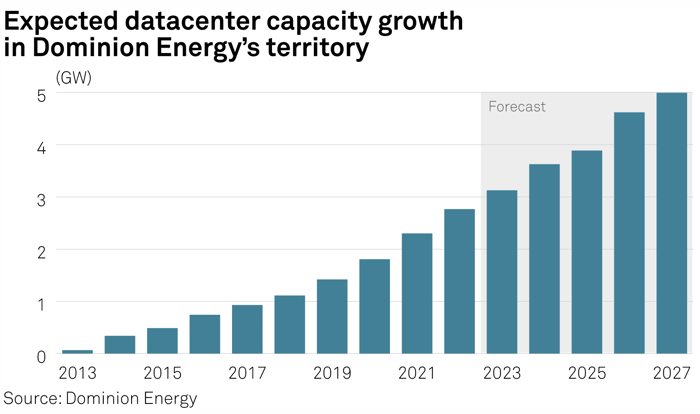

Dominion Energy, the utility serving the data center-dense region of Northern Virginia, exemplifies, in our view, the potential impact data center growth and the expansion of AI may have on electricity demand. The company recently submitted a regulatory filing detailing projected increases in its long-term forecast of electricity demand. These higher forecasts were prompted by the execution of long-term power agreements with data centers. Dominion stated that the strong demand will potentially triple the current level of demand to 5% annually sometime in the next 15 to 25 years.

Wisconsin Energy Group (WEC), a midwestern utility, also recently elevated its sales growth forecast for electric from 0.7%-1% for 2025-2027 to 4.5%-5% for 2026-2028. Commentary from the most recent earnings call indicated the projects driving this growth, many from Microsoft, are already underway. The impact digital infrastructure will have on electricity demand will not be universally consistent across the industry and will impact each utility company differently. Looking across the sector, however, we see demand increasing by a full 0.5% from data centers each year.

An optimistic outlook for utilities

Reaves has been investing in the data center space since 2018, drawn to its characteristics, including limited competition and compounding EPS growth through all market cycles. Equinix, for example, has grown revenue for more than 20 consecutive years.

We continue to appreciate the value of the core data center business model, driven by enterprise cloud service growth, and are intrigued by the potential impact of AI growth for these businesses. We are closely following how digital infrastructure and potential data center power demand could positively affect our utilities investments. While all utilities may not benefit alike, we believe many utilities stand to benefit from the need for power to cool these crucial server stack hotels. Coupled with EV expansion, we are encouraged by the potential this theme may provide for our investments in the utility sector.

Source: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/101623-power-of-ai-wild-predictions-of-power-demand-from-ai-put-industry-on-edge