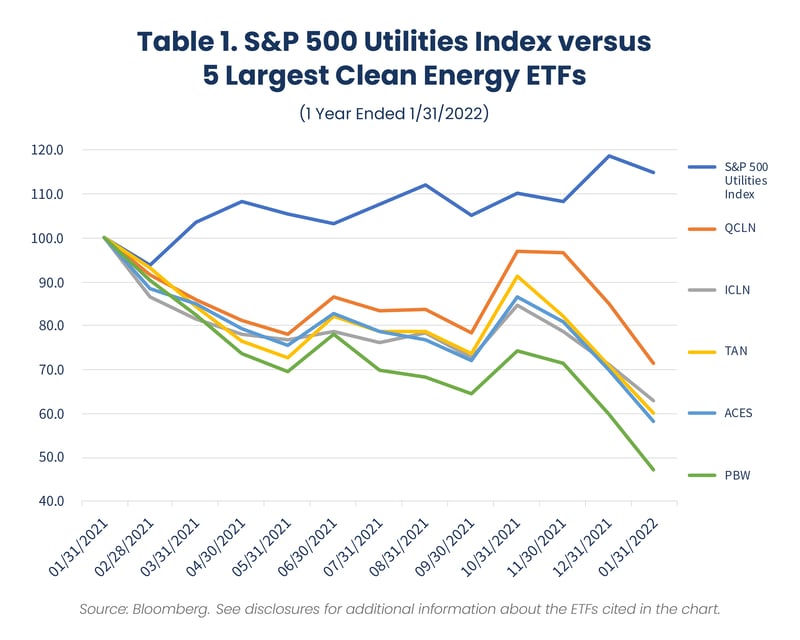

In a blog published last February, we noted that the Invesco Solar ETF (ticker: TAN)1, the top performing non-leveraged ETF in 2020 with a return of 234%, was a potential signal that clean-energy investing had become a mania as its surge higher in price attracted more and more investors. We cautioned readers that such speculative bubbles can be part of a pattern often experienced in the early phase of large-scale changes brought on by technological innovation.

Our concerns from a year ago have been confirmed as illustrated in the chart below (Table 1). In the one-year period ended this past Monday (1/31/22), the price of TAN has declined by -39.8%, and four of the largest clean energy ETFs (ranked by market capitalization)2 have also fallen sharply in value. In contrast, the S&P 500 Utilities Index3 has advanced by 14.9%.

Most of the largest clean energy ETFs seeking to capitalize on the energy transition theme were launched in the 2005-08 time frame. Their investment returns have historically been highly volatile, and, on average, have generated negative total returns from 6/30/08 through 1/31/22. In contrast, the S&P 500 Utilities Index had an annualized return of 8.0% over the same period.

Renewable energy transition and the long runway of projects required to support it, the increasing adoption of electric vehicles and the possible demand growth associated with it, and additional capital spending on grid infrastructure to strengthen transmission systems promoting greater service reliability — these developments underpin the case for investing in utilities to gain exposure to the energy transition theme.

In another previous blog, we made the case that utilities are leading the transition to renewable energy and should be considered as an impact investment. Many utility companies are directing large portions of their capital expenditures to solar, wind and other clean-energy generation projects. We expect that this will continue for many years given the expectations for renewables to represent more than 40% of total U.S. generation by 2050.4 These projects hold the potential to support future earnings and dividend growth and may provide appeal to investors seeking to capitalize on clean energy more conservatively.

Reaves Asset Management manages two funds which are concentrated in utilities stocks and are available to all investors: the actively managed Virtus Reaves Utilities ETF (NYSE Arca: UTES) and the Reaves Utility Income Fund (NYSE Amex: UTG), a closed-end fund. To learn more information about them and our firm please click on the links below.

Reaves Asset Management Website