Reaves Asset Management is attracted to companies that provide essential infrastructure services with characteristics such as high barriers to entry, limited competition, low risk of bankruptcy, and the ability to grow cash flow, earnings, and dividends through all economic cycles. We believe utility companies check all these boxes which explains why their stocks have been core holdings in portfolios managed with our Long Term Value Strategy1 since we entered the investment management business in 1978.

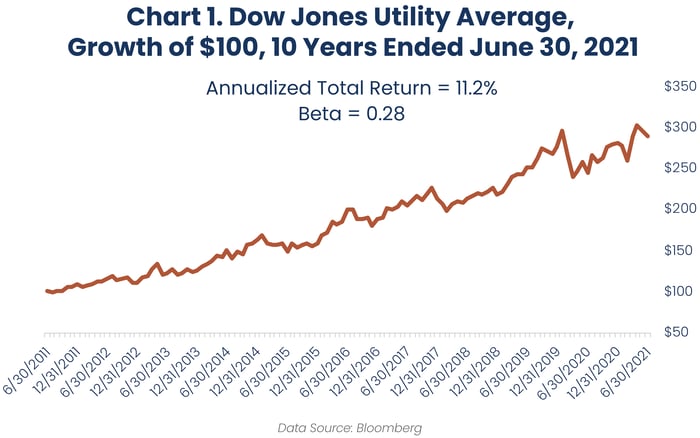

While the sector is rarely hyped by Wall Street strategists or market commentators who regularly appear on financial TV and radio, utilities2 have quietly delivered an annualized return of 10.9%, including dividends, over the past 43.5 years while posting a low beta of 0.44 relative to the S&P 500 Index. The chart below illustrates the hypothetical growth of $100, with reinvested dividends, over the 10 years ended 6/30/21 if an investor could have achieved similar returns to the Dow Jones Utility Average (DJUA). Notably, the returns and volatility of the DJUA over the past 10 years have been consistent with the historical returns cited above.

As we have written in several prior blogs, we believe the long-term growth tailwinds ongoing in the sector support our positive outlook for many utility companies. First and foremost, the transition away from fossil fuel-based generation to renewables, primarily wind and solar, is a multi-decade opportunity for utilities to invest capital to improve the environmental impact of their generation mix while in turn increasing rate base, a primary source of earnings growth. In the near term, proposed infrastructure legislation by the current administration highlights the significant investment incentives utilities are expected to receive in their continuing efforts to reduce carbon emissions, harden and upgrade electrical grids and transmission lines, and replace the aging water infrastructure necessary for the distribution of clean drinking water.

In addition, the electrification of transportation, supported by the growing adoption of electric vehicles, offers the possibility of growth in the demand for electricity, which has been relatively flat for the past 10 years. With widespread support from both politicians and state regulators for initiatives that combat climate change, we expect many utilities to enjoy constructive relationships with these parties in their efforts to strengthen and build out the infrastructure necessary to support electric vehicle adoption growth.

We have also observed several recent examples of utility holding companies simplifying their businesses by divesting non-core subsidiaries not directly related to the transmission or generation of electricity. We believe these initiatives are a sign of increasing confidence by management teams of the strength and future growth opportunities for their regulated businesses. This is supported by the more than 8% weighted average dividend growth of the holdings in our Long Term Value Wrap Composite in the past year.3 We would argue that such raises speak volumes about management team confidence in future growth potential.

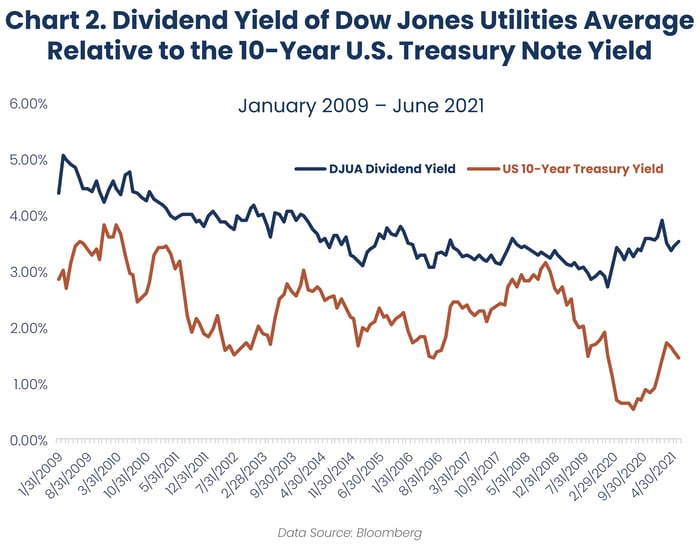

In our view, current valuations are also attractive. The chart below shows that the dividend yield of the Dow Jones Utility Average has remained above the yield of the 10-Year U.S. Treasury Note since early 2009, providing a margin of safety should interest rates move higher. The current spread, as of 6/30/21, is in excess of 200 basis points and near the upper end of the range since 2009.

At Reaves, we believe that a competitive dividend yield combined with mid-to high single digit growth in earnings and dividends is the recipe for achieving the steady, compounding growth we seek in our managed portfolios. We remain optimistic that utilities will continue to make a steady and healthy contribution to the future returns of our managed portfolios.

For our further thoughts about the utilities sector, we encourage you to review these previous blog posts:

- New Legislative Priorities May Have Big Implications for the Utility Sector

- The Case for Utilities as an Impact Investment

- Clean Energy Mania: A Long-Term Perspective on How to Invest in Renewables

- What Does Increasing Electric Vehicle Adoption Mean for Utilities?